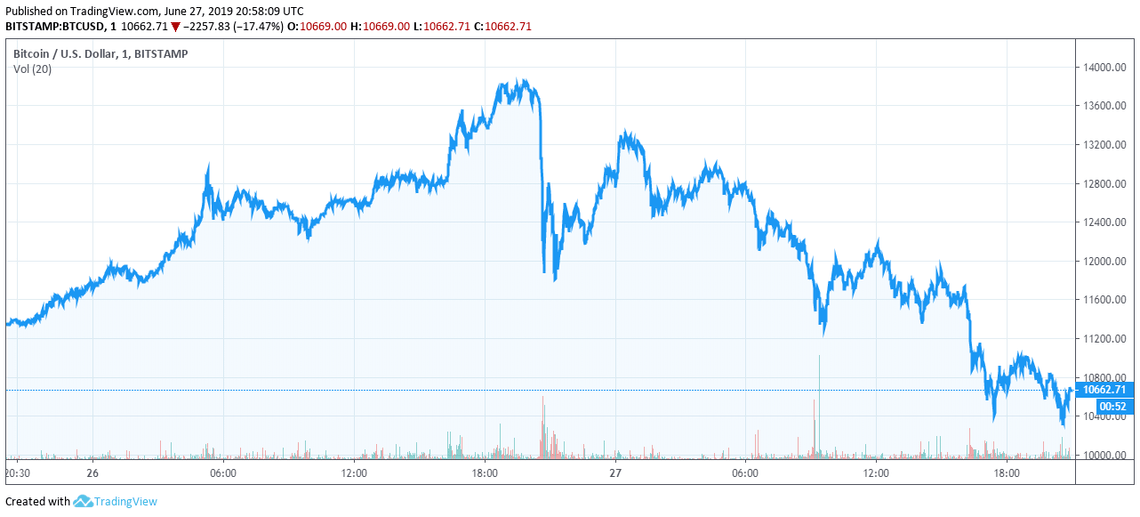

The rumor on the street is that Coinbase succumbing to technical difficulties led to a significant $1,400 drop in the price of Bitcoin across the entire global cryptocurrency market.

If this is remotely true, that would mean too much of the crypto market relies on a single outlet.

But can it be? Or did bears simply seize on the opportunity?

Coinbase Was Offline, So How Can They Get the Blame?

Every rise has its ups and downs on the way up. That’s just the way the market works.

You can’t blame an overall market incentive on one exchange going offline for a little bit.

Coinbase typically carries a higher price than the rest of the market.

Their platform provides enormous liquidity for the US market, and retail sellers often cash out through them.

People may be quick to attribute a crashing price to Coinbase, but the platform being offline is precisely why they’re not to blame.

The orderbooks are a little insane right now.

On Coinbase, a $27M market sell will crash Bitcoin to 10k from 12.5k.

A $27M market buy will send Bitcoin to 10k from 19k. pic.twitter.com/sjOW983t0v

— Avi Felman (@AviFelman) June 26, 2019

Whatever happened in the market, they had nothing to do with it.

The race to the next all-time-high is not a line straight up.

There are necessary setbacks along the way, and if there are $5,000 gains over the month, you can expect hundreds or even thousands in a retracement.

It’s unclear if it would have been better or worse if Coinbase had been around.

Coinbase Helped the Bitcoin Price Get Here in the First Place

Plenty base their predictions on the activity of exchanges like Coinbase, which services much of the retail market.

Coinbase plays an essential role in the overall adoption of Bitcoin.

They now support multiple cryptocurrencies, including Litecoin and EOS. People can directly purchase or sell these now on the retail version of the service.

For the theory that Coinbase going offline played into the downward pressure on the market to be accurate, the company would have to be the biggest market maker around.

Although it’s one of the largest on-ramps ever built for crypto, Coinbase is far from the largest crypto exchange by volume.

As far as legitimate exchanges go, Binance probably holds that title.

Binance is currently looking to move into the US with a Coinbase-like offering.

The exchange will be banning US users from its current primary offering.

This is a gamble, overall. US users who are looking to use a regulated product with limited functionality might end up with Coinbase.

If you were to blame the price drop on Coinbase, then moving forward would you credit them with a new all-time high?

It seems unlikely.

Therefore, it makes no sense.

Coinbase going down was but one factor. It might have limited the losses, in truth, with many new retail investors unable to sell.

So stop blaming them.