By CCN: Jason Calacanis, a prominent Silicon Valley investor who has helped companies such as Uber and Robinhood to secure multi-billion dollar valuations, has said the bitcoin price is likely to drop to $0 to $500 in the long-term.

“My position remains the same. Bitcoin will likely be replaced by a new technology & it’s manipulated It’s possible it’s built to last, but not probable, so keep your position to an amount you’re willing to loose. For most, that’s 1-5% of net worth. It will likely go to 0-$500,” Calacanis noted.

With Robinhood supporting crypto asset trading and some of the portfolio companies of Calacanis like Abra focusing on the crypto sector, why is Calacanis pessimistic about the future of bitcoin?

Will bitcoin fail because crypto sector hasn’t matured enough?

In early 2018, on a blog post, Calacanis said that he does not hate crypto nor bitcoin. But, he expressed concerns about the crypto sector driven by scams and fear of missing out (FOMO).

Calacanis said:

- I don’t hate crypto, but I do hate seeing people get scammed out of their money.

- The space is now driven by scams, FOMO, and FOCO, which means it’s going to end very badly for a lot of people. (FOCO is the fear of cashing out.)

- Feel free to invest a lot of your time, if so inclined, but be very careful with your money.

During the 2017 bull market when the mainstream was first attracted to the crypto sector, many poor initial coin offering (ICO) projects and malicious actors plagued the industry.

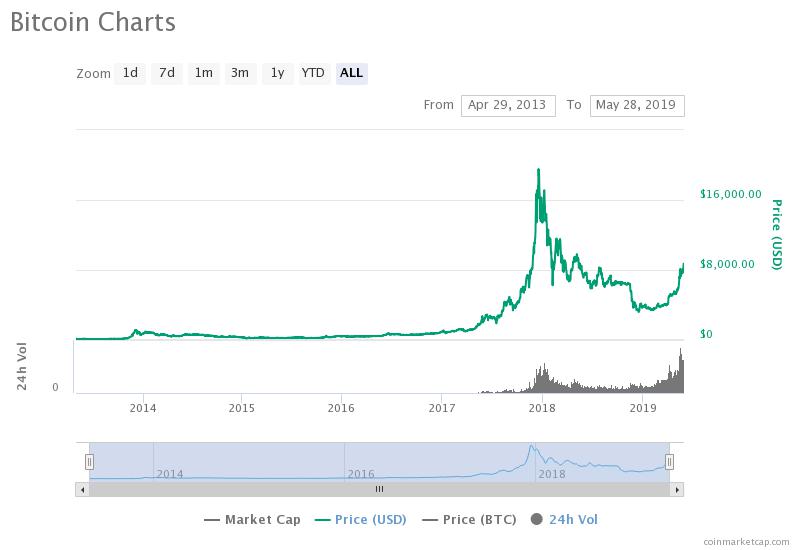

Following the parabolic rally of bitcoin which saw the dominant cryptocurrency hit a price of $20,000, the market crashed, leaving many retail investors drained psychologically and financially.

After crashing to $3,150, the bitcoin price has since rebounded to nearly $9,000 (source: coinmarketcap.com)

Calacanis previously said that he does not approve of the structure of the crypto sector and the lack of maturation of the industry.

But, recently, Calacanis stated that the bitcoin price could rise to as high as $100,000 before crashing down to $0, adding:

Said another way, bitcoin is likely MySpace, Yahoo or Palm, which all seemed inconceivable at their peaks. It might hit 100k a coin before going to zero — we will see.

Calcanis holds bitcoin. The investor said that his team holds some bitcoin and whether or not it succeeds, it will be a win-win for his portfolio.

We own some bitcoin, in case my 70% assessment doesn’t come true. We win either way.

— 🦄🦄🦄🦄🦄🦄🦄 (@Jason) May 28, 2019

The emphasis of Calacanis seems to be the speculative nature of any emerging asset class like cryptocurrencies and the risk of investing in an asset like bitcoin.

Hence, as said by other industry executives such as Xapo CEO Wences Casares, for both retail investors and large funds, it would be safe to hold a portion of a portfolio that could be lost in an unlikely scenario that bitcoin struggles over the long run.

In an essay, Casares said that portfolios should hold at most 1 percent of bitcoin at most considering the high risk involved in the investment.

“I suggest that a $10 million portfolio should invest at most $100,000 in Bitcoin (up to 1% but not more as the risk of losing this investment is high). If Bitcoin fails, this portfolio will lose at most $100,000 or 1% of its value over 3 to 5 years, which most portfolios can bear. But if Bitcoin succeeds, in 7 to 10 years those $100,000 may be worth more than $25 million, more than twice the value of the entire initial portfolio,” Casares said.

Approach with caution

The message of Calacanis to investors seems to be to approach investment into the crypto sector with caution and with a proper investment thesis.

In the upcoming months, as the infrastructure supporting cryptocurrencies strengthens with the entrance of trusted custodial providers and regulated exchanges in the likes of Fidelity, ICE’s Bakkt, and TD Ameritrade, the crypto market could become more stable for both retail investors and institutions.