By CCN: Cannabis stocks are all the rage following last year’s explosion in the sector. With legalization gaining steam in both the U.S. and Canada, investors are piling into these companies as if they are going to be the next great money-making scheme.

The problem is most of these stocks aren’t worth real green. They are only worth what the market says they are worth, and that value is going to decline for almost all of them. Only a few may be worth looking at.

These three cannabis stocks, in particular, are sucker’s bets.

Intec Pharma: Cannabis Drug Delivery Fails

Intec Pharma Ltd. (NTEC) is a clinical-stage biotech firm with Accordion Pill Platform Technology. The tech allegedly boosts the effectiveness of drugs by better controlling how they are retained and released in the stomach.

It has two Phase III trials in development, one for Parkinson’s disease symptoms and another for insomnia.

In regards to cannabis, Intec says the Accordion Pill is aimed to deliver:

“…either or both of the primary cannabinoids contained in Cannabis sativa, cannabidiol (CBD) and tetrahydrocannabinol (THC) for various indications including low back pain, neuropathic pain and fibromyalgia.”

The delivery system failed its study, however.

The reason to stay far away from NTEC stock is that its success is entirely tied to the Phase III trials of its non-cannabis drugs.

About 90% of all drug trials fail at some point in the process, and its cannabis development program just tanked.

This means NTEC stock is not supported by either revenue or earnings. So a savvy investor will ask whether Intec will even be able to stay in operation until finishing trials.

Even if it does, but the drugs fail, the NTEC stock goes to zero. Plus, what happens if there are government policy changes?

This cannabis stock is valued at $171 million, so be mindful that NTEC is purely speculative.

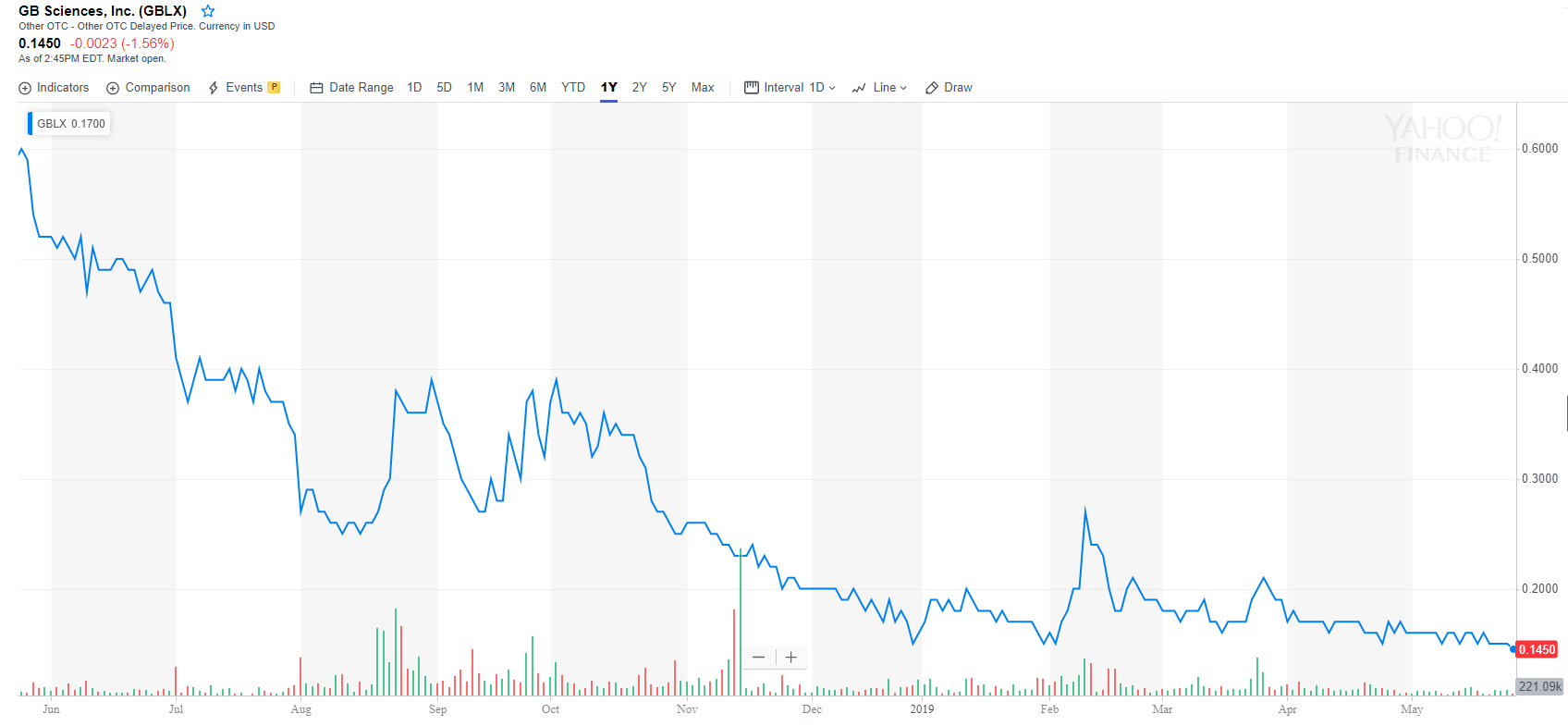

GBLX Stock: A Penny Stock Worth Pennies

GB Sciences (GBLX) is a penny stock that cultivates and dispenses medical and recreational cannabis in Nevada.

GBLX also derives extracts and oils from cannabis plants and distributes cannabis-infused coffees and teas.

GBLX stock actually does have revenue — $3.6 million over the past 12 months. Yet GBLX is undone by expenses, which has resulted in a $28 million net loss over the same period. GBLX stock is thus valued at an outrageous price of 10 times revenue.

The major reason to stay away from this cannabis stock, though, is that it doesn’t do anything special. It is not the only game in town as far as selling cannabis products. With ongoing legalization in both the US and Canada, more and more companies will be vying for the market.

That means cannabis products will become the bane of all markets: commodities.

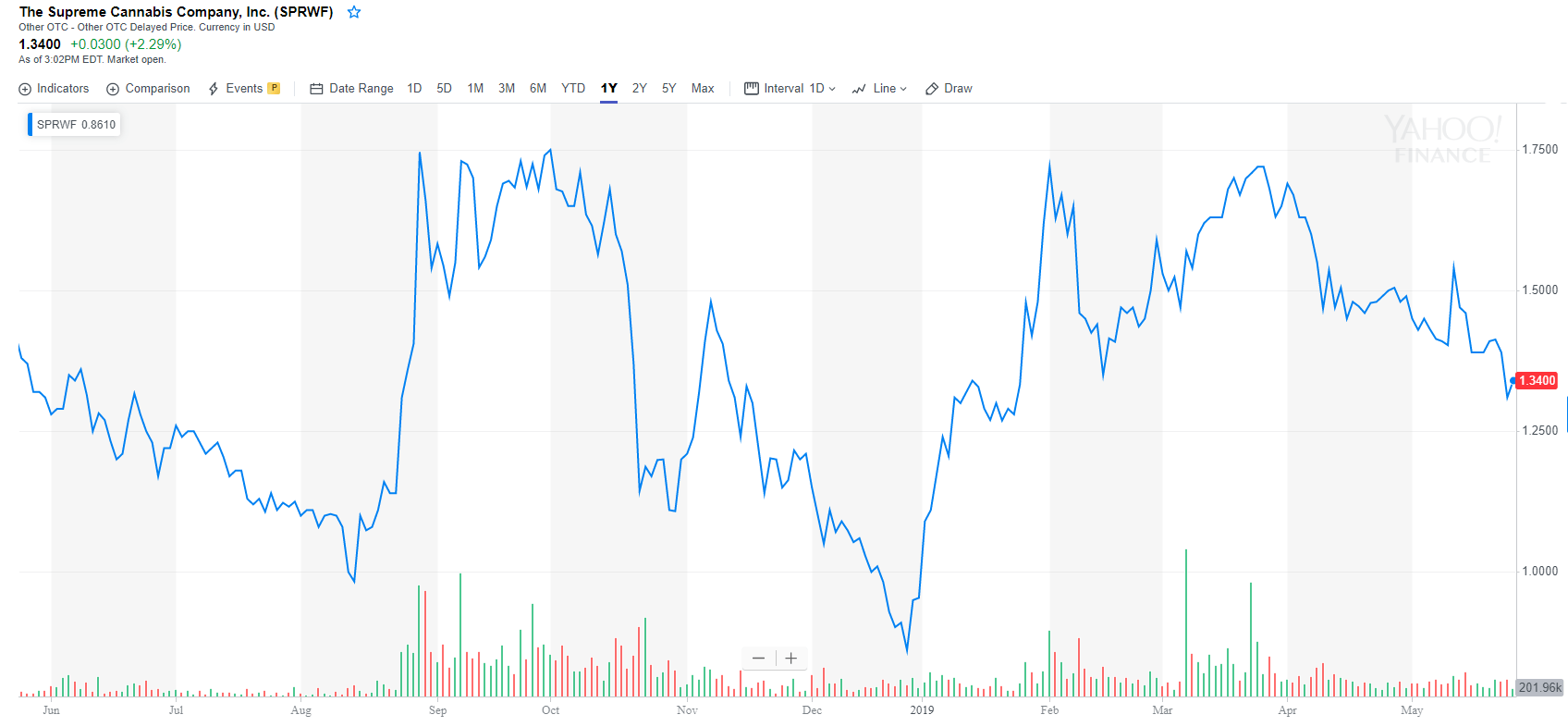

SPRWF: Stay Away from This Cannabis Stock

Supreme Cannabis Company (SPRWF) is a Canadian play that distributes “consumer-centric proprietary Cannabis plant products.”

SPRWF stock is prone to the same problem that GBLX stock is: commoditization. It sells consumer products directly to middlemen. There will be no winners in this market, just non-losers.

Amazingly, SPRWF stock is supported by real revenue, to the tune of about $24 million over the past 12 months. However, SPRWF generated a $14 million net loss over the same period, and the market still values SPRWF stock at $384 million, or 16 times revenue.

If one thinks GBLX is outrageously priced at 10 times revenue, SPRWF stock is even more foolishly overpriced.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.