By CCN.com: In the past week, the bitcoin price has increased by around 7.3 percent against the U.S. dollar from $5,220 to $5,600, achieving a new 2019 high.

While the upside movement of the dominant cryptocurrency is generally considered to be technical, some theorize that the unexpected increase in the volume of the U.S. bitcoin futures market may have triggered the BTC run.

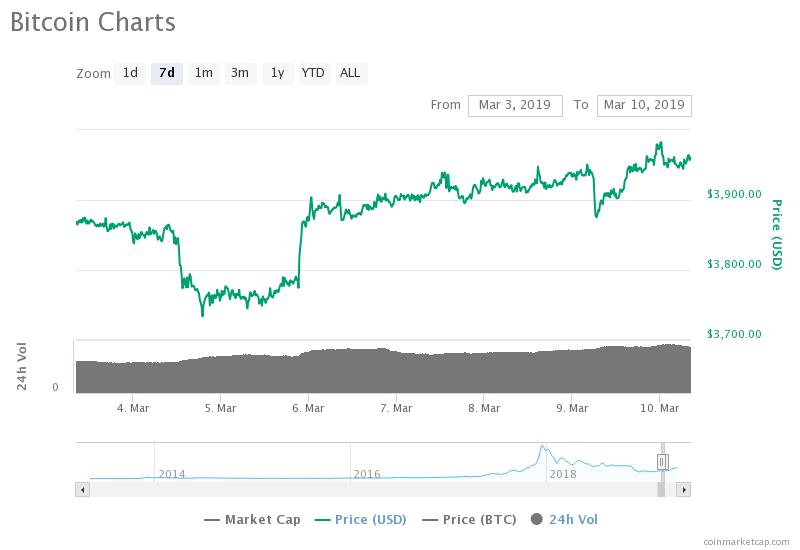

Bitcoin is up more than 7 percent in the past week, outperforming many crypto assets (source: coinmarketcap.com)

Interestingly, throughout the past 24 hours, only bitcoin amongst the top ten most valuable cryptocurrencies in the global market has recorded a gain against the USD, showing some maturation in the market with independent price movements.

Independent Price Movements in Bitcoin and Crypto Markets is a Positive Indicator

Earlier this year, following the initial 20 percent surge in the bitcoin price from $4,200 to $5,000, Multicoin Capital general partner Vinny Lingham stated that the cryptocurrency rally is most likely not sustainable due to the lack of independent price action.

He said:

Many people believe that the crypto winter is over. Here are some of my unfiltered thoughts on this topic. Charts & technicals aside, I don’t believe this rally is sustainable for one reason: The market has not yet decoupled the various crypto assets from Bitcoin.

In recent weeks, both major cryptocurencies and small market cap tokens have begun to show some decoupling, less correlated with the price trend of bitcoin.

On April 24, for instance, the bitcoin price recorded a slight 1.13 percent, maintaining its momentum above the $5,500 level.

However, most cryptocurrencies in the likes of ethereum, bitcoin cash, ripple, EOS, litecoin, and binance coin recorded losses in the range between 2 percent to 8 percent.

“So, even if the Bitcoin network effect or store of value hypothesis results in an increased price, this currently translates into broader market based upon sentiment, not fundamentals. So in practice, other cryptos get a boost from any improvements in Bitcoin fundamentals today,” Lingham explained, adding that assets would have to decouple from bitcoin to make the rally sustainable.

As the volume in the market recovers and some investors begin to take profits from more risky options by hedging to BTC, the market is likely to see signs of stabilization in the weeks to come.

“The key indicator for the start of a sustainable bull run is likely a decoupling of asset values from Bitcoin (i.e. Bitcoin’s strength weakens other networks or vice versa). Anything else is just speculation again,” he added.

That said, if we can break $6200 for BTC, it will likely mark the start of another major bull run and could run hot and high, but if it’s pure speculation and other assets benefit disproportionately to value created, it’s likely not going to end well again!

— Vinny Lingham (@VinnyLingham) April 10, 2019

Currently, technical analysts foresee $6,000 as a crucial level for bitcoin and surpassing it may lead to the start of a new rally for the asset.

Fundamental Factors

As suggested by ShapeShift CEO Erik Voorhees, the daily transaction volume on the Bitcoin network has been on the rise since 2009.

Although the transaction volume of BTC dipped in late 2017 coming off of a large bull market, it has recovered strongly from January 2018 to April 2019.

The most important chart in crypto https://t.co/XME5jivO5x #bitcoin #blockchain #finance

— Erik Voorhees (@ErikVoorhees) April 23, 2019

With the support of various fundamental factors and the volume of the bitcoin market up by nearly two-fold since March based on the “real 10” volume calculated using the methodology introduced by Bitwise Asset Management, as long as the volume of the asset holds, an upside movement in the medium-term is expected.