By CCN: The Dow and broader U.S. stock market traded mixed-to-lower on Monday, as disappointing housing data threw cold water on hopes that the real estate sector was finally turning a corner after last year’s slowdown.

Dow Struggles; S&P 500 Flat-Lines

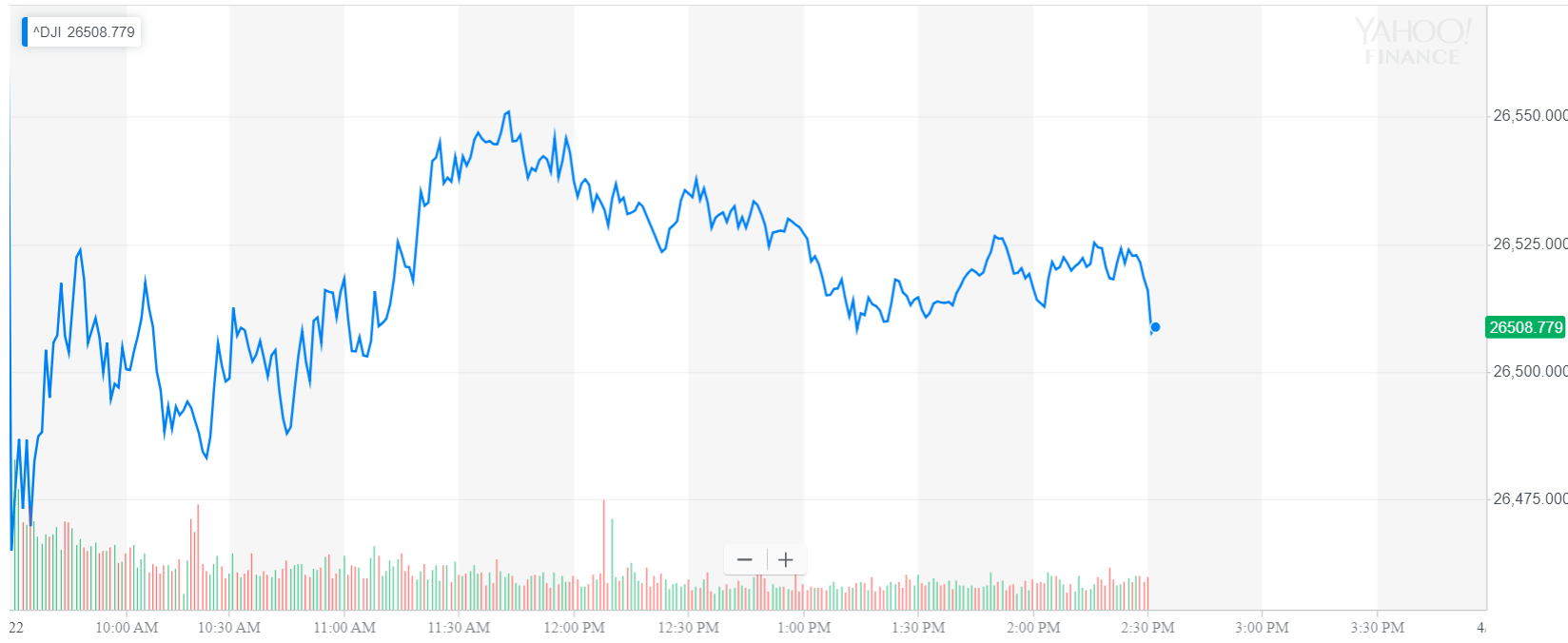

After losing as much as 101 points, the Dow Jones Industrial Average pared losses to trade 48 points lower at 26,511.52.

The broad S&P 500 Index of large-cap stocks pared losses to settle at 2,905.16, where it was virtually unchanged. Energy stocks surged 2% as oil prices extended their rally. Real estate, the S&P 500’s smallest component, fell 1.7%.

Meanwhile, the technology-focused Nasdaq Composite Index edged up 0.1% to 8,006.64.

U.S. equity markets traded quietly on Monday, as investors shifted their attention to a bevy of big-tech earnings later in the week. Facebook Inc. (FB), Amazon.com (AMZN) and Dow blue-chip Microsoft Corp (MSFT) are all scheduled to report their financial results later this week.

Stock Market on Edge as Housing Slowdown Worsens

U.S. housing market shows further signs of weakness at the end of the first quarter, which doesn’t bode well for the stock market over the long-term. | Source: Shutterstock.

U.S. existing home sales languished more than expected last month, as affordability challenges continued to weigh on consumer demand.

Previously-owned home sales, which account for the vast majority of the U.S. housing market, fell 4.9% in March to a seasonally adjusted annual rate of 5.21 million units, according to the National Association of Realtors (NAR). That was the most significant monthly decline since November 2015. Analysts in a median forecast called for a drop of 3.8%.

“It is not surprising to see a retreat after a powerful surge in sales in the prior month. Still, current sales activity is underperforming in relation to the strength in the jobs markets. The impact of lower mortgage rates has not yet been fully realized,” said NAR chief economist Lawrence Yun.

The U.S. housing market has slowed to a crawl in recent years, as a supply-demand mismatch at the lower end of the price range exacerbated affordability challenges in the market. There is a growing belief that 2019 will be a positive year for housing now that the Federal Reserve has all but abandoned its plans to raise interest rates any further. The federal funds rate impacts mortgages indirectly as banks pass on the higher costs to their customers.