By CCN: After a promising start, the Dow and broader U.S. stock market gave back most of their gains Tuesday, as a volatile health sector roiled investors’ confidence after UnitedHealth raised serious questions about a new Medicare for All bill proposed by House Democrats.

Dow Crashes from Session Highs

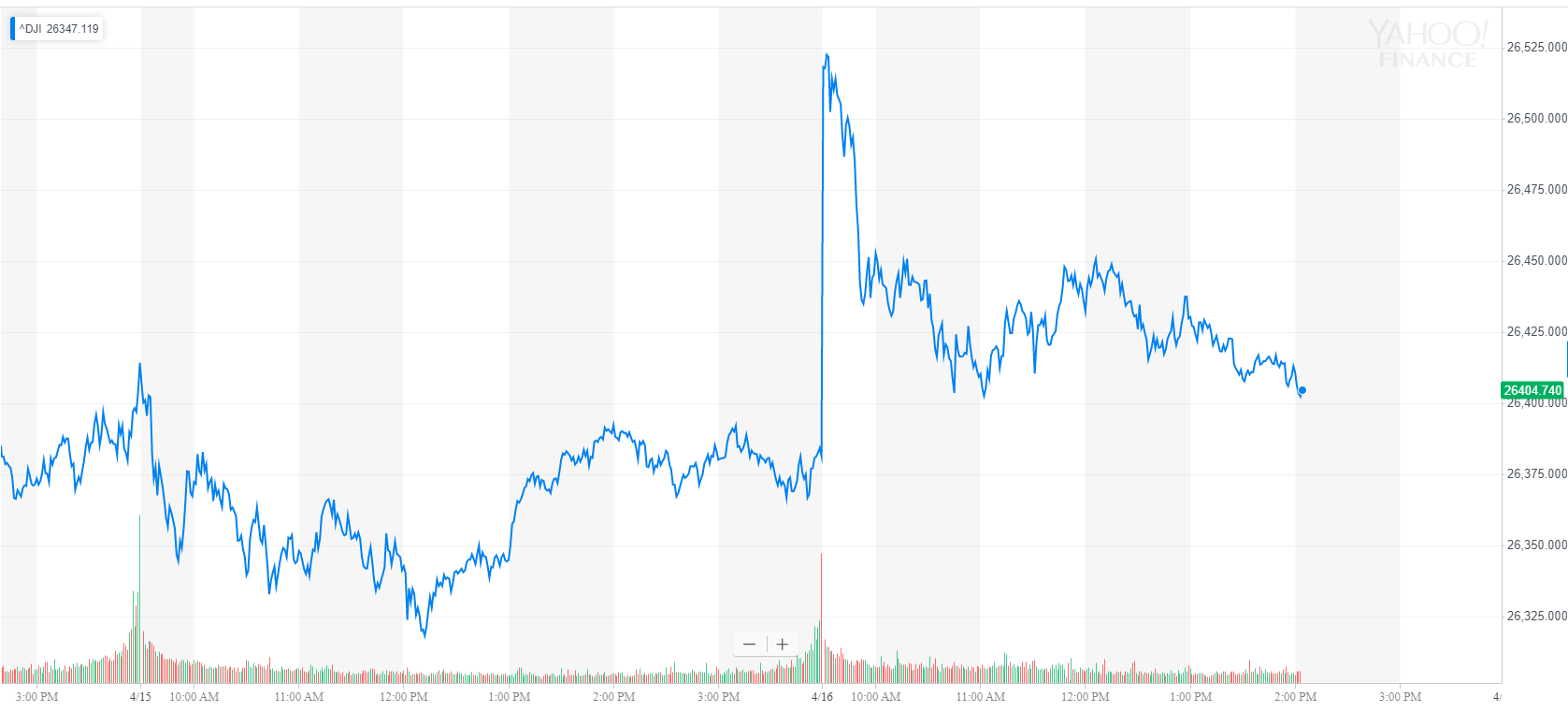

All of Wall Street’s major indexes rose sharply after the open, reflecting a solid pre-market for Dow futures. The Dow Jones Industrial Average climbed as much as 146 points before giving up the vast majority of the rally later in the day. It was last up just 20 points, or 0.1%, 26,404.99.

Dow Jones Industrial Average gives up the bulk of its gains on Tuesday. | Chart via Yahoo Finance.

The broad S&P 500 Index of large-cap stocks advanced 0.1% to 2,906.89, also giving up most of its gains for the day. The index had come within nine points of its all-time high. Financials and consumer discretionary were the S&P 500’s best-performing sectors while health care, utilities, and real estate lagged.

Meanwhile, the technology-focused Nasdaq Composite Index booked gains of 0.3% to reach 8,003.27.

CEO: Bernie Sanders & Medicare For All Would Destabilize Health System

UnitedHealth Group Inc. (UNH) posts better than expected financial results but warns of proposed legislation supported by Bernie Sanders and other top Democrats. | Source: Shutterstock.

Health care was one of the S&P 500’s worst-performing components Tuesday after the CEO of UnitedHealth Group (UNH) raised concerns about a Democrat-led initiative to expand Medicare. David Wichmann says the Medicare for All bill proposed by Democrats in the House of Representatives – and supported by presidential candidates like Bernie Sanders – threatens to “destabilize the nation’s health system.”

The warning comes even as UnitedHealth, a Dow blue chip, raised its profit guidance for the year thanks to higher than expected revenue across all units of its business. The country’s largest health insurer reported adjusted earnings of $3.73 on revenue of $60.31 billion. Both figures were higher than a year ago and also exceeded the median estimate of analysts polled by Refinitiv.

UnitedHealth raised its full-year adjusted earnings outlook to between $14.50 and $14.75 from a prior forecast of $14.40 to $14.70.

The best-performing sector of 2018, health care is now the S&P 500’s worst-performing group. As of Tuesday, shares within the group are up 4.2% compared with a nearly 16% gain for the broader index.