Donald Trump continues to alarm Wall Street with his unprecedented assault on the independence of the U.S. Federal Reserve. In an aggressive tweet on April 14, Trump seethed that “killer” Fed policies had clobbered the Dow Jones Industrial Average to the tune of 5,000 to 10,000 points, wiping as much as 40% off the stock market’s historic bull run.

Is this realistic? Of course not.

If the Fed had done its job properly, which it has not, the Stock Market would have been up 5000 to 10,000 additional points, and GDP would have been well over 4% instead of 3%…with almost no inflation. Quantitative tightening was a killer, should have done the exact opposite!

— Donald J. Trump (@realDonaldTrump) April 14, 2019

Dow Jones Actually Shrugged Off Most Rate Hikes

Specific figures aside, let’s assume Trump generally means that the Fed derailed economic progress by raising interest rates four times in 2018. Even that, however, proves to be a hollow critique given the stock market’s actual reaction to most rate increases.

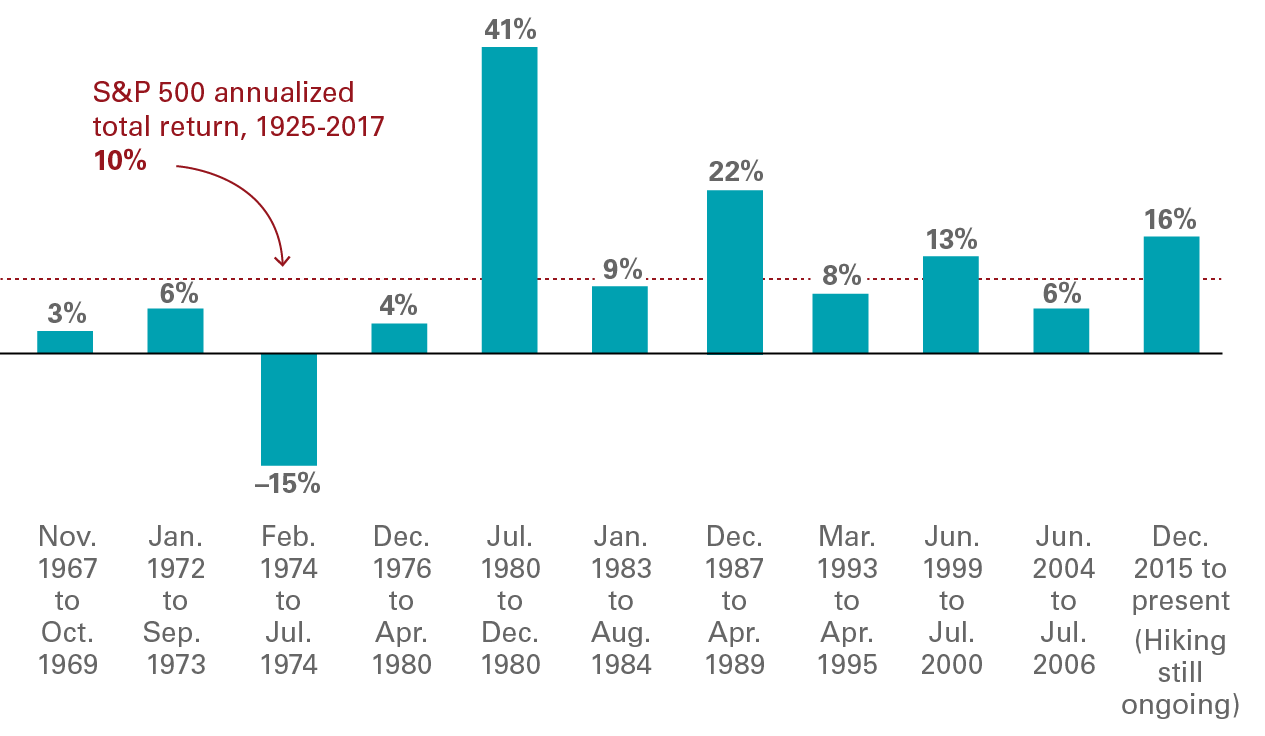

Conditions for many years loosened after Federal Reserve “rate hike” meetings. The USD sold off in the wake of many of the rate decisions, and the Dow often reacted positively because rate hikes were a symbol of US exceptionalism in a sluggish global economy. Similarly, the S&P 500 nearly always rises during a tightening cycle.

Reasonable rate increases are nearly always a positive thing for the stock market. | Source: Vanguard Group

Trump-Pumped Dow Simply Ran Out of Gas

Enter Donald J. Trump, who pumped an already overbought Dow as hard as he could with free cash for corporations. He did this in part to shield the stock market from his anti-free trade protectionist agenda, and it worked for a while.

The Dow has surged during Trump’s presidency, but he blames the Fed for the fact that it hasn’t gone even higher. | Source: Yahoo Finance

The chickens came home to roost at the end of 2018. Trump’s disastrous China trade war was a driving factor, but investors faced plenty of other risks, too – like Brexit and a European slowdown. Wall Street greedily chased markets higher in 2018, and the December sell-off was a natural, healthy correction.

As confidence returned this year, the buyers jumped back on board. What Trump appears to be saying is that the Dow Jones should have just kept going up in a straight line. Well, markets don’t just go straight up. He poured gasoline on the fire with tax cuts, and, ironically it brought on the inevitable dip more quickly.

POTUS Schemes to Change the Narrative

Let’s be real. Trump doesn’t actually believe the Fed is out to ruin his presidency.

Voters blame the White House for both the government shutdown and the trade war, both of which arguably contributed to the Dow’s late 2018 struggles. Trump continues to fight against that narrative by making the Fed a scapegoat. That way he can claim the market peaks for himself and dump the responsibility for the troughs on someone else.

Don’t be so naïve as to think he believes he – or anyone else – can predict where the market’s going.