The Dow and broader U.S. stock market edged closer to record highs on Friday after two of America’s biggest banks reported better than anticipated corporate results, proving once again that you can fool investors by setting expectations low enough.

Dow Surges While S&P 500 Clears 2,900

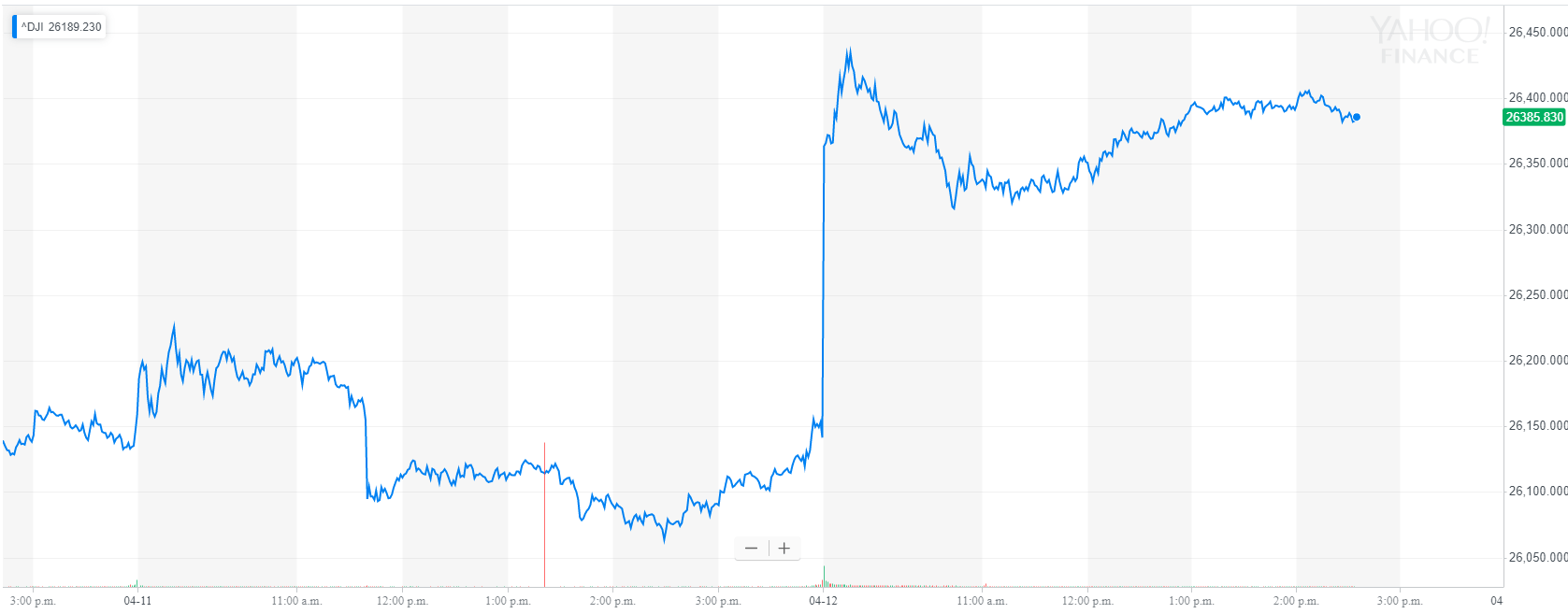

All of Wall Street’s major indexes reported gains Friday, reflecting a solid pre-market session for Dow futures. The Dow Jones Industrial Average surged 242 points, or 0.9%, to 26,385.96.

The Dow Jones Industrial Average plowed closer to a new all-time high. | Chart via Yahoo Finance.

The broad S&P 500 Index of large-cap stocks climbed 0.6% to 2,905.03, with ten of 11 primary sectors reporting gains. Financials, industrials, and materials each rose more than 1% as a group.

Meanwhile, the technology-focused Nasdaq Composite Index advanced 0.4% to 7,978.15.

How to Engineer a Stock Market Rally

JPMorgan Chase & Co once again “surprises” to the upside with its latest earnings call. | Source: REUTERS/Benoit Tessier

For the past three years, corporate earnings have been a boon to Wall Street, helping to perpetuate the Dow’s longest bull market in history. During reporting season, investors are routinely flooded with news that company X or Y has produced better than expected results. Sometimes investors don’t realize that when you set your expectations low enough, positive earnings and revenue surprises aren’t all that impressive.

In other words, earnings expectations are another way that the Street engineers stock rallies, which feeds into the mandate of company executives whose compensation is structured around increasing share prices. (Sometimes this incentive leads to outright earnings manipulation, but we’ll leave that to a separate discussion.)

On Friday, shares of JPMorgan Chase & Co (JPM) and Wells Fargo & Co (WFC) received a sizable pump after both banks produced better than expected bottom-line results. However, as Hacked reported Thursday, expectations weren’t exactly difficult to surmount. For example, JPMorgan was expected to earn an adjusted $2.35 per share on revenue of $28.47 billion. Both estimates represent declines year-over-year. Instead, the bank reported $2.65 per share on revenue of $29.12 billion.

Forecasters said they lowered their expectations because of the impact of lower mortgage rates, an inverted yield curve, and slowing economic growth, among other reasons. While mortgage rates declined, they remain higher than they were a year ago. Besides, it’s not entirely clear that higher mortgage rates are desirable when home sales are in a multi-year downturn due to affordability challenges. Meanwhile, the yield-curve inversion was a temporary occurrence in March so it’s not entirely clear that this could pressure earnings in any meaningful way. On the topic of economic growth, the United States has cooled in the last two quarters but is still performing much better than its advanced industrialized peers.