The Dow lagged the broader U.S. stock market on Wednesday, with Boeing shares resuming their slide after preliminary findings of the Ethiopian Airlines crash revealed that the pilot followed the aircraft’s emergency procedures – a stark contradiction to Boeing’s earlier claims.

Dow Lags as S&P 500, Nasdaq Boom

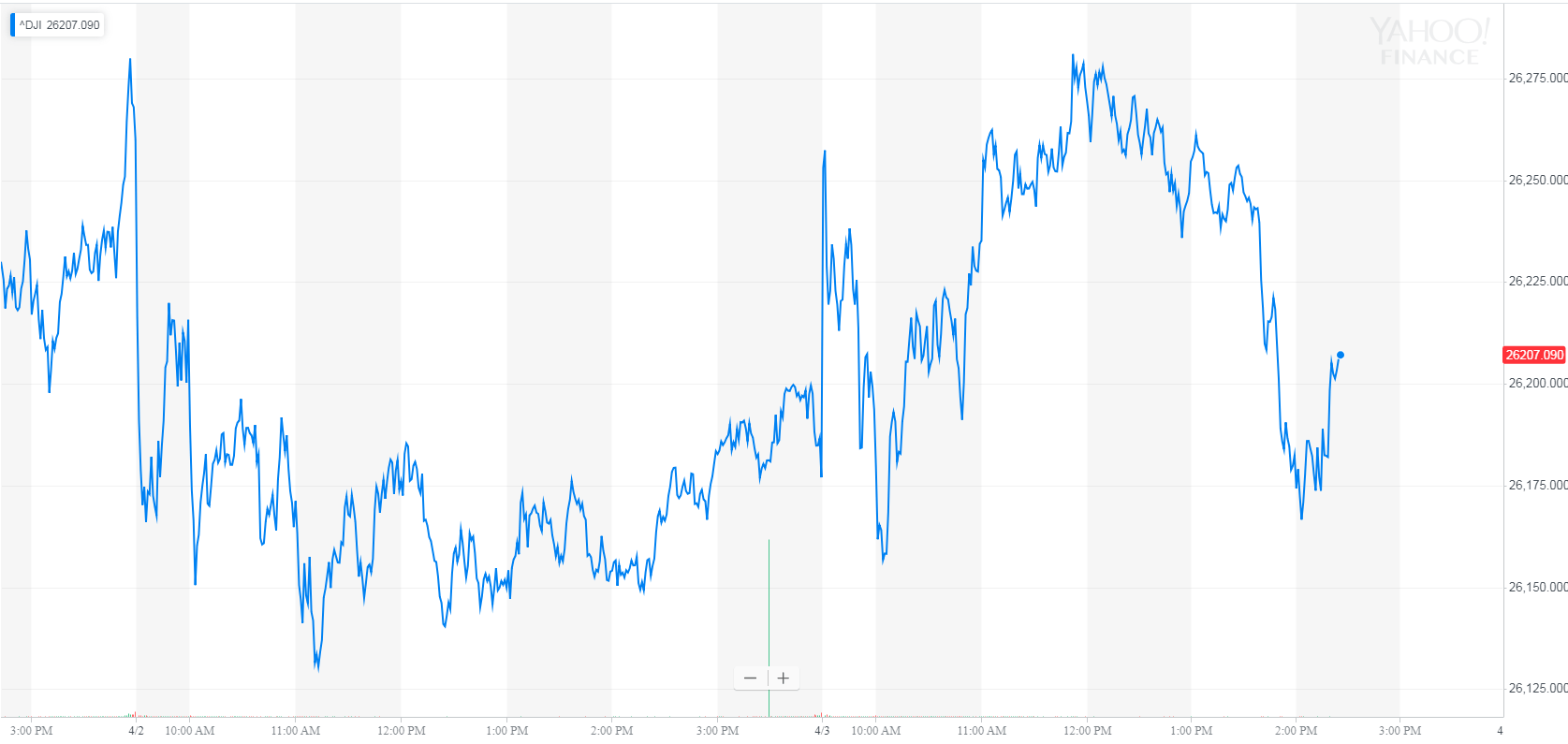

The Dow Jones Industrial Average edged up 28 points, or 0.1%, to 26,207.16. The blue-chip index had gained as much as 103 points, reflecting a strong pre-market for U.S. stock futures.

Wall Street’s other major indexes edged closer to record highs on Tuesday. The S&P 500 Index climbed 0.3% to 2,874.62, with six of 11 primary sectors reporting gains. Materials stocks saw the biggest gains, rising 1.5% as a collective. Technology stocks rose 0.8%.

The technology-focused Nasdaq Composite Index jumped 0.7% to 7,900.72.

The CBOE Volatility Index, also known as the VIX, moved in the same direction as stocks. VIX climbed 4.3% to 13.94 on a scale of 1-100 where 20-25 represents the historic average.

Boeing Woes Continue to Roil Dow

Boeing shares under pressure after preliminary report contradicts the company’s safety assessment. | Source: Shutterstock

Shares of Boeing Co (BA) fell 1.3% after a preliminary report showed that the pilots manning doomed Ethiopian Airlines Flight 302 initially followed the aircraft’s emergency procedures. The findings raised renewed concerns about the safety of Boeing’s MAX 737 MAX airplanes, which have been grounded in more than two dozen countries. It has also called into question Boeing’s assertion that the disaster could have been avoided if the pilots simply followed established procedures.

The airplane plunged from the sky shortly after take-off outside of Addis Ababa on March 10, killing all 157 people on board.

Neither Boeing nor the Federal Aviation Administration (FAA) has confirmed the report, which was initially published by The Wall Street Journal. A Boeing spokesman did issue the following statement:

“We urge caution against speculating and drawing conclusions on the findings prior to the release of the flight data and the preliminary report.”

Boeing’s stock was recovering for the better part of two weeks after the aircraft manufacturer announced that a new software fix on its 737 MAX fleet would soon be implemented. The stock plummeted nearly 18% between March 1 and March 22.