As Bitcoin’s sudden rally higher captures the world’s attention, it is not only the cryptocurrency investment that is racing back into the light. Any company associated with BTC is experiencing a green day, and naturally, Riot Blockchain (RIOT) is no exception. Despite fading a lot of its daily gains, the crypto mining outfit is still up more than 20%, outperforming most cryptocurrencies.

Riot Blockchain Lives and Dies With the Bitcoin Price

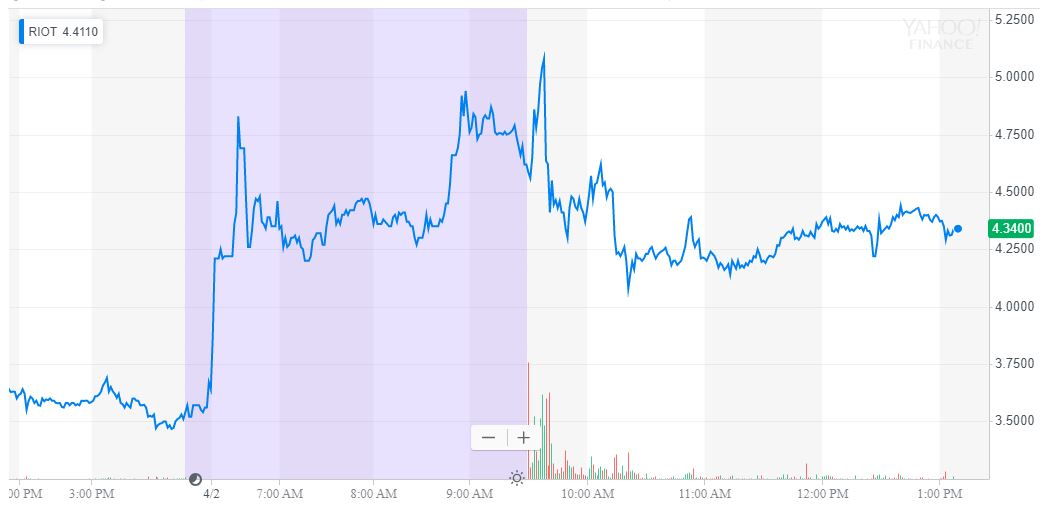

Riot Blockchain popped more than 20% in response to the crypto market’s similar surge. | Source: Yahoo Finance

Most articles in the mainstream financial media are pushing the “no-one knows” line about the rally in the Bitcoin Price. Anyone who read this article on CCN yesterday knows that BTC/USD was on the verge of breaking a significant technical level. In an illiquid market where everyone is watching momentum and price action way more than they look at fundamentals, a mass of trend following orders would naturally spike the market aggressively.

Understanding what would cause appetite for Riot Blockchain to surge higher is even more straightforward. They are mostly a cryptocurrency mining outfit but recently announced plans to launch an exchange. Ultimately, this means that upside and revenue for the Nasdaq-listed Riot are based not only around price but also trading appetite in general. Both Bitcoin and altcoins are important to their bottom line.

‘Bitcoin’ Hits #2 on Google Trends

If you are thinking about launching a cryptocurrency exchange, what is your most important fundamental? Probably, interest in the space in general.

Given that Bitcoin was number two on Google’s trending metric in the United States, interest looks ready to explode again. Obviously, a dip in price might immediately quash this interest. I would venture the speed with which BTC returned to the headlines might be some proof that appetite was merely hibernating and never died out.

Risky Stock Market Exposure to Cryptocurrency

Riot Blockchain has had its fair share of controversies but appears to be coming through them unscathed. It has undeniably posted some tremendous gains in the last few weeks. For investors looking for high reward/high-risk stock market exposure to digital currency, it is arguably the most high-profile play.

Nasdaq-Listed Riot Blockchain Is Still a Boom or Bust Play

The nature of Bitcoin mining (or any mining for that matter) is extremely cyclical. For this same reason, un-diversified companies who are dealing exclusively in one commodity are always volatile. RIOT is a great play when the going is good, and an equally bad one when things get rough. To be a long-term investor, you would probably want to see some diversification into the conventional blockchain field away from cryptocurrency. That is assuming you are not anticipating Bitcoin is heading directly to the moon.

Until anything changes significantly, Riot Blockchain will remain a risk-on play in a bull market as prices rise, and a cautionary tale in a bearish one.