On April Fools’ Day last year, Tesla CEO Elon Musk tweeted that the electric carmaker had gone bankrupt. Of course it was a joke and fortunately, those were the good old days before the U.S. Securities and Exchange Commission started taking issue with Musk’s tweets.

Tesla Goes Bankrupt

Palo Alto, California, April 1, 2018 — Despite intense efforts to raise money, including a last-ditch mass sale of Easter Eggs, we are sad to report that Tesla has gone completely and totally bankrupt. So bankrupt, you can’t believe it.— Jung Musk (@elonmusk) April 1, 2018

But what was a joke a year ago might now seem prescient given Tesla’s current challenges. Already, Tesla is burning cash at a fast rate financing ambitious expansion plans even as demand for its products wanes. Deutsche Bank has, for instance, downgraded the carmaker’s price target citing weaker-than-expected demand for the Model 3 in the U.S. This has been blamed partly on cuts to federal tax credits earlier in the year.

Tesla has also experienced delivery problems in Europe and China, two markets that the carmaker had placed huge bets on.

Model Y Could Add More Problems to Tesla

Tesla’s launch of a new compact SUV has not helped matters either with analysts warning that it could actually compound the carmaker’s problems. At present, the compact SUV niche is one of the best-selling segments in the auto industry. However, Tesla won’t make the Model Y available until in the next half of next year. This creates several problems for Tesla.

First, the crossover SUV could dampen purchases of existing Tesla cars as customers choose to wait for its release. With prices starting at $39,000, the Model Y is likely to cannibalize Model 3 sales more than any other brand.

Secondly, who knows whether this segment will still be popular by then? By the time the first Model Y is available for sale, tastes and preferences among car buyers could have changed.

Additionally, Tesla’s launch of a new compact SUV, the Model Y, has also raised concerns that the carmaker’s financial position could be further put under increased pressure. Several analysts said the Model Y will necessitate the raising of money later in the year.

Tesla’s Cash Reserves Dwindles by Another $920 Million in one Payment!

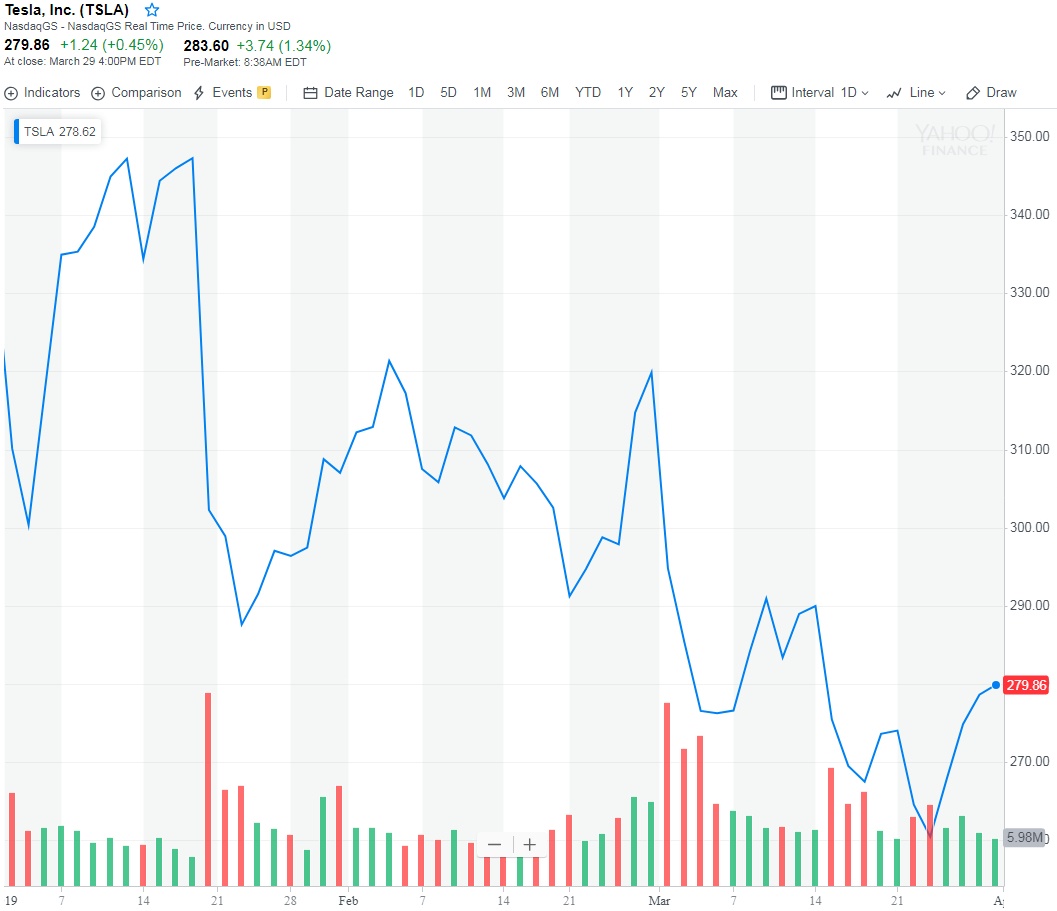

At the beginning of last month, the electric car maker made its biggest-ever bond payment where it used up close to a quarter of the cash that it had. Tesla made the payment in cash for the convertible senior notes worth $920 million. This is because its stock price had fallen below the level it was at the time the debt was issued.

The conversion price of the notes was $359.87 a share. Had the stock been priced higher, the bonds could have been converted into stock and Tesla wouldn’t have had to pay in cash. Currently, Tesla’s stock price is under $280.

And despite paying off its debt as scheduled, Tesla’s creditworthiness remains under pressure. Per Moody’s Investors Service, this is due to the strategy reversals and operational missteps experienced in the current quarter.

Tesla’s creditworthiness still “strained,” Moody’s says https://t.co/QTEqkAQ1Dp

— MarketWatch (@MarketWatch) March 15, 2019

Having surprised markets by enjoy two consecutive profitable quarters, it is not yet time for Tesla bears to celebrate though as the carmaker could still steer itself in the right direction. This view is supported by financial services firm Canaccord Genuity which expects Tesla to move faster launching new products than traditional automakers while keeping its lead in electric vehicles. And that’s no April Fools’ prank.