The Dow and broader U.S. stock market surged on Monday after better than expected Chinese data eased concerns about a protracted slowdown in the global economy. The preponderance of evidence still points to a weakening Chinese economy – a fact that investors will still grapple with in the near future.

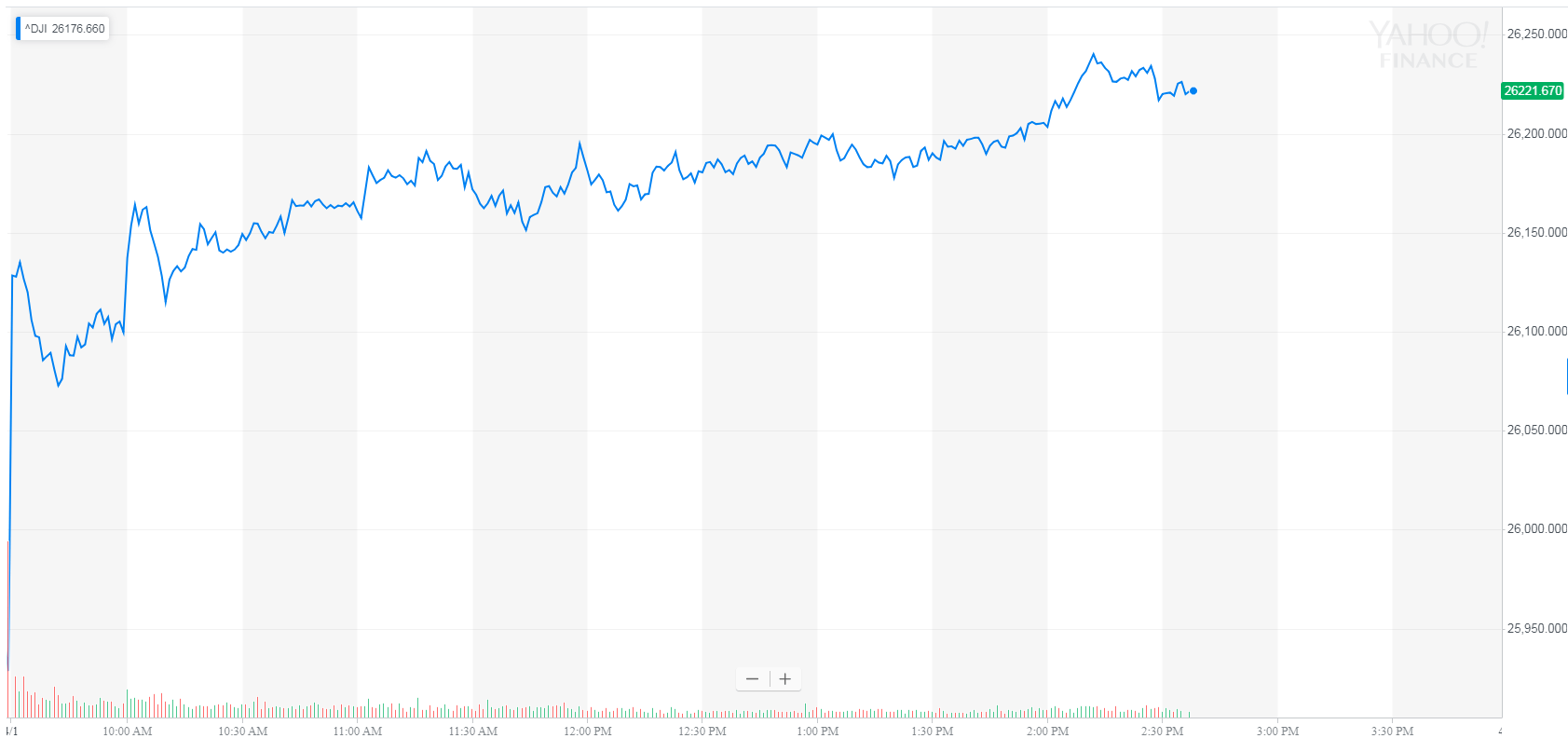

Dow Rockets Past 26,000; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes put up huge gains at the start of the week, reflecting a strong early session for Dow futures. The Dow Jones Industrial Average surged 294 points, or 1.1%, to 26,222.74.

The broad S&P 500 Index of large-cap stocks gained 1% to 2,864.73, where it was inching closer to record territory. Eight of 11 primary sectors reported gains, led by financials.

The technology-focused Nasdaq Composite Index jumped 1.2% to 7,820.54.

China Data Provides (False) Hope

Seemingly-bullish economic data from China caused global stock markets to shoot higher, but hopes of a recovery won’t pan out. | Source: REUTERS / Stringer

Wall Street and global stocks surged on Monday after a pair of PMI reports confirmed that China’s manufacturing sector had emerged from recession.

The Caixin/Markit Manufacturing Purchasing Managers’ Index rose to 50.8 in March, its highest in eight months and well above the median estimate forecast by economists. On the PMI scale, a reading above 50 implies growth. Before March, the Caixin manufacturing index had been in contraction for three consecutive months.

On Sunday, the government’s official manufacturing gauge improved to 50.5 in March from 49.2 the month before. The official non-manufacturing PMI, which tracks activity in the services industries, jumped 0.5% to 54.8.

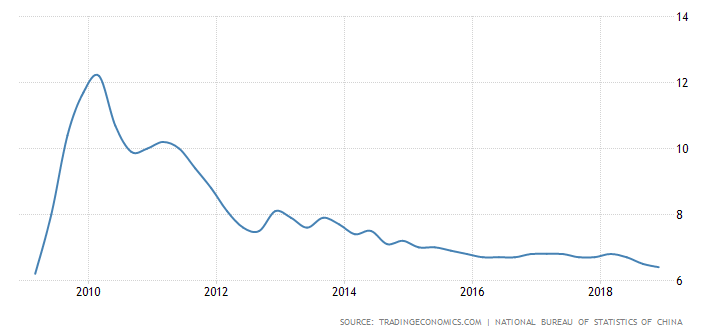

While PMI data imply that China’s economy has turned a corner, the nation remains locked in a multi-year downtrend that has been exacerbated by a prolonged trade war with the United States. Trade between the two superpowers plunged in January at the fastest pace in 17 years.

Beyond the immediate trade picture, China’s rate of economic growth has been slowing for the better part of a decade. Although this was expected when Beijing first announced it was shifting focus to services and consumption and away from exports, the pace of the slowdown has accelerated.

Below is a snapshot of China’s annualized GDP growth between 2010 and 2018.

China’s annualized GDP growth is trapped in a nearly decade-long downtrend. | Source: TradingEcomomics.com

As far as the global economy goes, the International Monetary Fund, World Bank, and Organization for Economic Cooperation and Development have all reduced their growth forecasts for the year.