By CCN.com: The Dow quivered leading into Thursday’s US trading session after a vindictive President Trump unleashed a savage scatter-shot tweetstorm directed at his political enemies. The cryptocurrency market, meanwhile, remained rigid as bitcoin traders begged for something to catalyze a breakout.

Nervous Dow Struggles for Direction

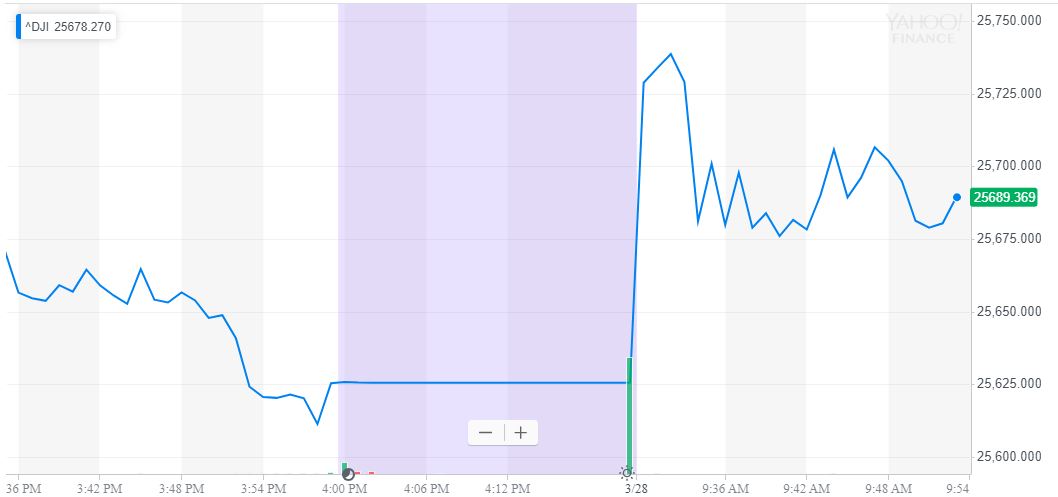

The Dow Jones Industrial Average recovered from a tepid pre-market session to surge more than 100 points shortly after the opening bell, but the index began to slide just minutes later. As of 9:56 am ET, the Dow had gained 61 points or 0.24 percent. The S&P 500 and Nasdaq also experienced minor bumps, rising 0.23 percent and 0.27 percent, respectively.

On Wednesday, a volatile Dow ultimately dropped 32.14 points or 0.13 percent, despite surging to triple-digit gains immediately after the opening bell. The Nasdaq and S&P 500 fared even worse, with the former shedding 0.63 percent and the latter careening down 0.46 percent, leaving it just 5.37 points above the crucial 2,800 level.

Trump Tweetstorm Overshadows ‘Unprecedented’ Trade Deal Progress

One would expect that Wall Street would be mashing the buy button this morning following a blockbuster report that US and Chinese negotiators had made massive progress toward overcoming crucial hurdles that have prevented the two economic superpowers from sealing the deal on a new trade agreement.

Report: US & China Make Major Breakthrough

US and Chinese negotiators reportedly made significant progress on trade deal sticking points, including intellectual property rights. | Source: REUTERS/Thomas Peter

According to Reuters, China made “unprecedented proposals” on several issues, most notably the thorny issue of intellectual property.

“If you looked at the texts a month ago compared to today, we have moved forward in all areas. We aren’t yet where we want to be,” one anonymous senior US administration official said. “They’re talking about forced technology transfer in a way that they’ve never wanted to talk about before – both in terms of scope and specifics.”

Instead, index prices are hovering around their previous-day closes, suggesting that other factors are spooking traders heading into the week’s penultimate trading session.

That may be because Wall Street is grappling with a newly-emboldened Donald Trump who on Thursday unleashed a savage shotgun-blast of tweets aimed at a cavalcade of his political enemies, both foreign and domestic.

President Unbound: Trump Goes Ballistic over Mueller Probe, Oil Prices

The president began his morning social media routine much like any other, tossing rhetorical daggers at the “Fake News Media” who are suffering a major “breakdown” and have “never been more corrupt than it is right now.” He later lobbed a targeted insult at MSNBC’s “Morning Joe,” gloating that its ratings had “tanked” since Attorney General William Barr indicated that the Mueller report had failed to establish that he or anyone associated with his 2016 presidential campaign had engaged in any criminal wrongdoing related to Russia’s interference in the election.

Wow, ratings for “Morning Joe,” which were really bad in the first place, just “tanked” with the release of the Mueller Report. Likewise, other shows on MSNBC and CNN have gone down by as much as 50%. Just shows, Fake News never wins!

— Donald J. Trump (@realDonaldTrump) March 28, 2019

He then turned his attention back to Mexico, which he alleges is doing “NOTHING to stop the flow of illegal immigrants” into the US. “May close the Southern Border!,” Trump warned.

Mexico is doing NOTHING to help stop the flow of illegal immigrants to our Country. They are all talk and no action. Likewise, Honduras, Guatemala and El Salvador have taken our money for years, and do Nothing. The Dems don’t care, such BAD laws. May close the Southern Border!

— Donald J. Trump (@realDonaldTrump) March 28, 2019

That’s when things began to get more interesting. First, Trump revealed that the FBI and Department of Justice would review the “outrageous” Jussie Smollett case, which saw the “Empire” star walk away virtually scot-free despite allegedly faking a hate crime. “It is an embarrassment to our Nation!,” he complained.

FBI & DOJ to review the outrageous Jussie Smollett case in Chicago. It is an embarrassment to our Nation!

— Donald J. Trump (@realDonaldTrump) March 28, 2019

Trump then laid into Rep. Adam Schiff (D-CA), accusing the House Intelligence chairman of “knowingly and unlawfully lying and leaking” about the Mueller investigation and ranting that he should be “forced to resign.”

Congressman Adam Schiff, who spent two years knowingly and unlawfully lying and leaking, should be forced to resign from Congress!

— Donald J. Trump (@realDonaldTrump) March 28, 2019

At last check, Trump had begun to wade into the financial markets. Alleging that “World markets are fragile,” the president warned that it is “very important” that OPEC ramp up oil production to ease up pressure on prices.

Very important that OPEC increase the flow of Oil. World Markets are fragile, price of Oil getting too high. Thank you!

— Donald J. Trump (@realDonaldTrump) March 28, 2019

Crude was down $0.48 or 0.81 percent as of the time of writing.

While Wall Street has by now become accustomed to Trump’s trigger-happy Twitter thumbs and early-morning tweetstorms, it’s understandable that traders would proceed with caution until the tweetclouds had past.

Crypto Market on Edge as Bitcoin Price Teeters at $4,000

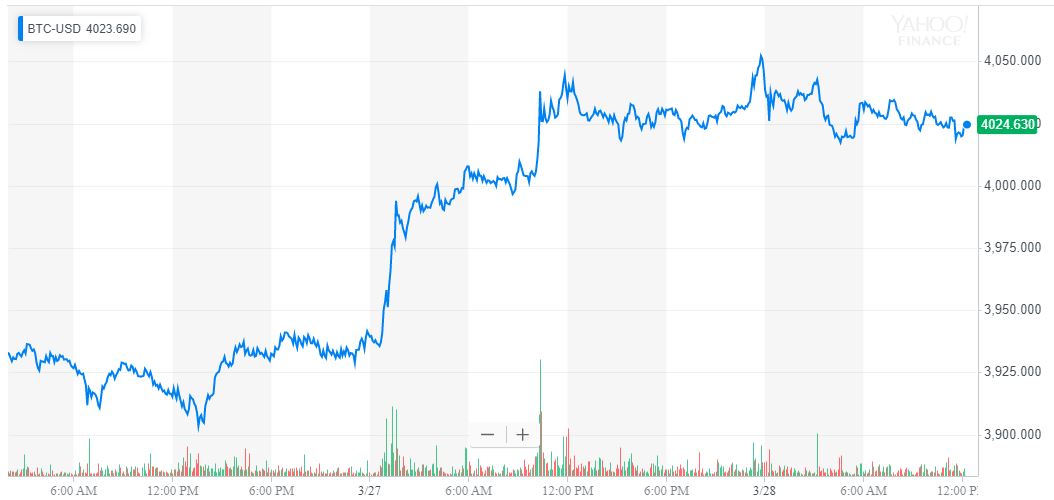

The cryptocurrency market, meanwhile, continues to trade sideways inside a tight window while investors wait to see whether the bitcoin price has enough momentum to catalyze an upward push past resistance at $4,200.

The bitcoin price rally has stalled since the flagship cryptocurrency bounced back above $4,000. | Source: Yahoo Finance

Optimists allege that a strong push past this mark would initiate a new bull market, but bitcoin bears point to declining trading volumes as one of several factors that should make investors hesitant to buy into the rally.

For now, the bitcoin price is holding at $4,024, representing virtually no change over its previous-day level. Most other large-cap cryptocurrencies remain uncomfortably quiet as well, though EOS – which just recently broke above its 200-day moving average – added another 4.27 percent to its already-impressive rally to climb to $4.27.