The Dow and broader U.S. stock market sank on Wednesday, as investors tried to piece together a narrative to explain the apparent stalling of China trade negotiations ahead of next week’s summit in Beijing.

Dow Slides as Much as 135 Points

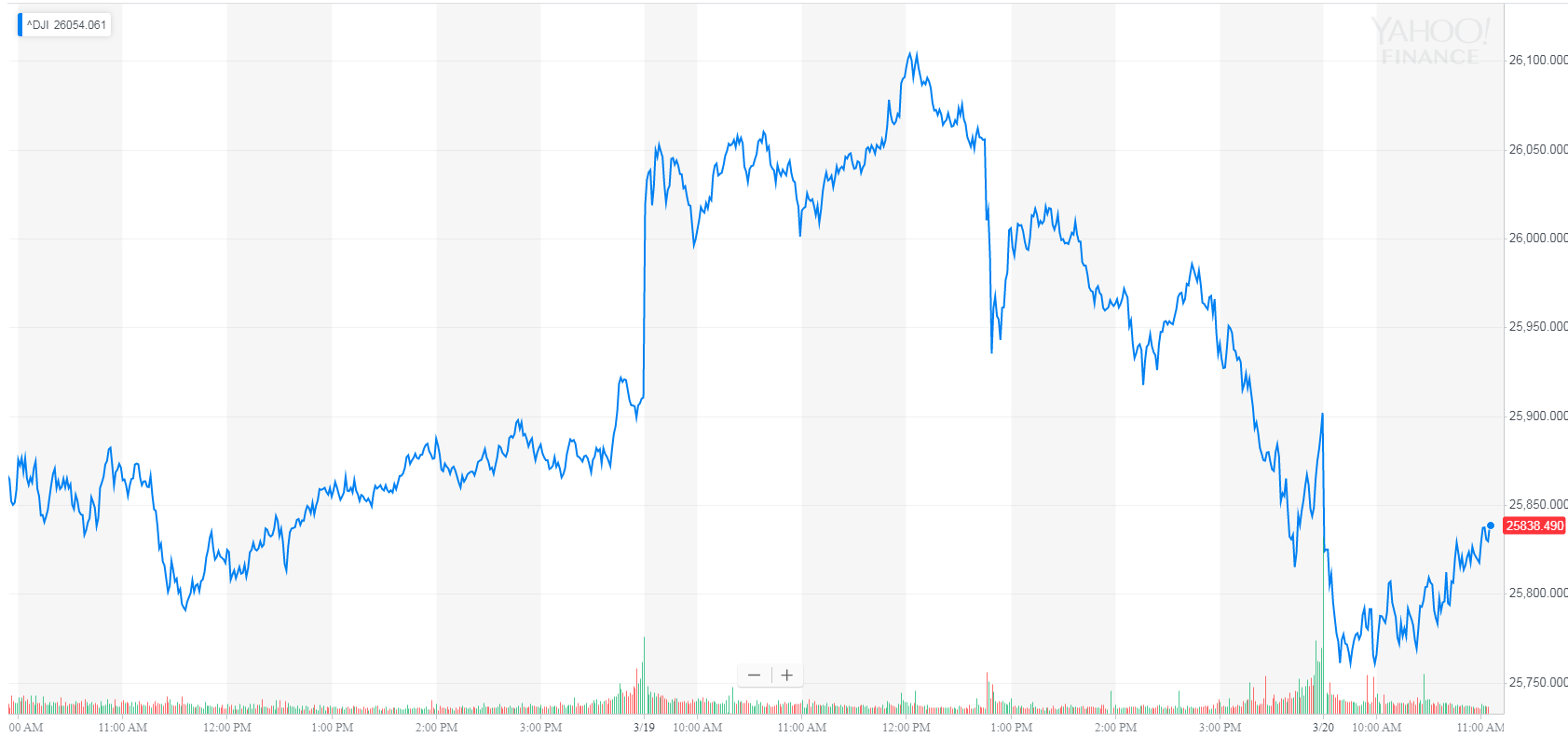

All of Wall Street’s major indexes pivoted lower midweek as investors shifted their focus to monetary policy and trade negotiations. The Dow Jones Industrial Average declined by as much as 135 points, reflecting a tepid pre-market for U.S. stock futures. At last check, the Dow 30 index was off 48 points, or 0.2%, to 25,838.70.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

The Dow fell by as much as 135 points on Wednesday. | Source: Yahoo Finance

The broad S&P 500 Index of large-cap stocks dropped 0.2% to 2,828.97, with most major sectors reporting losses. Healthcare was the biggest laggard, falling 0.6% as a sector. Shares of financials and materials companies were down by at least 0.4%.

The technology-focused Nasdaq Composite Index pared losses and was last down 0.1% at 7,718.35.

A measure of implied volatility known as the CBOE VIX rose for a third consecutive day, a sign that risk aversion was slowly creeping back into the picture. VIX, also known as the “fear index,” jumped 3.7% to 14.06, the highest in over a week.

U.S.-China Trade War Back in the Spotlight

China and the United States are set to resume trade negotiations next week. | Source: Alex Wong / Getty Images / AFP

Stocks came under pressure late Tuesday after the Trump administration confirmed it was sending a trade delegation to Beijing next week to resume negotiations. As Hacked reported, Beijing seems to have reneged on some of its trade concessions because it isn’t convinced that the U.S. will lift tariffs on Chinese goods.

President Trump is sending his heavy hitters to Beijing in the week of March 25, a strong signal that both sides are looking to resolve their bitter dispute. U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will be part of the delegation that is scheduled to meet with Chinese Vice Premier Liu He. Liu is expected to make a return visit to Washington, D.C. the following week.

Trade tensions between the two superpowers have cast a dark shadow over global economic growth. The International Monetary Fund and Organization of Economic Cooperation and Development have both downgraded their global growth forecasts for 2019. China’s economic stagnation shows no sigs of slowing anytime soon, as evidenced by the latest round of trade and industrial production data.