By CCN.com: This week is looking to end on a positive note for bitcoin, as the cryptocurrency clawed its way above $4,100, adding $1 billion to its market cap in the process.

Bitcoin Price Cracks $4,100 as Bullish Sentiment Grows

The bitcoin-to-dollar rate established an intraday high at $4,103, up 2.24-percent since Friday’s opening price. The session peak also marked bitcoin’s highest mark since February, leading many to believe that the cryptocurrency was finally breaking out of its prolonged bearish bias. The shift in sentiment has been building since bitcoin’s sharp reversal from the $3,100-3,200 range last December, which recovered the asset’s price by as much as 34.23 percent.

The crypto bear market has been over for three months now. $BTC breaking above 4200 will mark the end of the bear trend that started in January 2018. Going to miss this big fellow. pic.twitter.com/nzsUhmDYXm

— Alex Krüger (@krugermacro) March 29, 2019

Nevertheless, the upside push looked attractive only from the intraday perspective, for it lacked the volume required to declare a breakout action. We covered our view elaboratively here, discussing three converging bearish factors that could withhold bitcoin gains from flourishing any further.

History Doesn’t Bode Well for this Latest Bitcoin Push

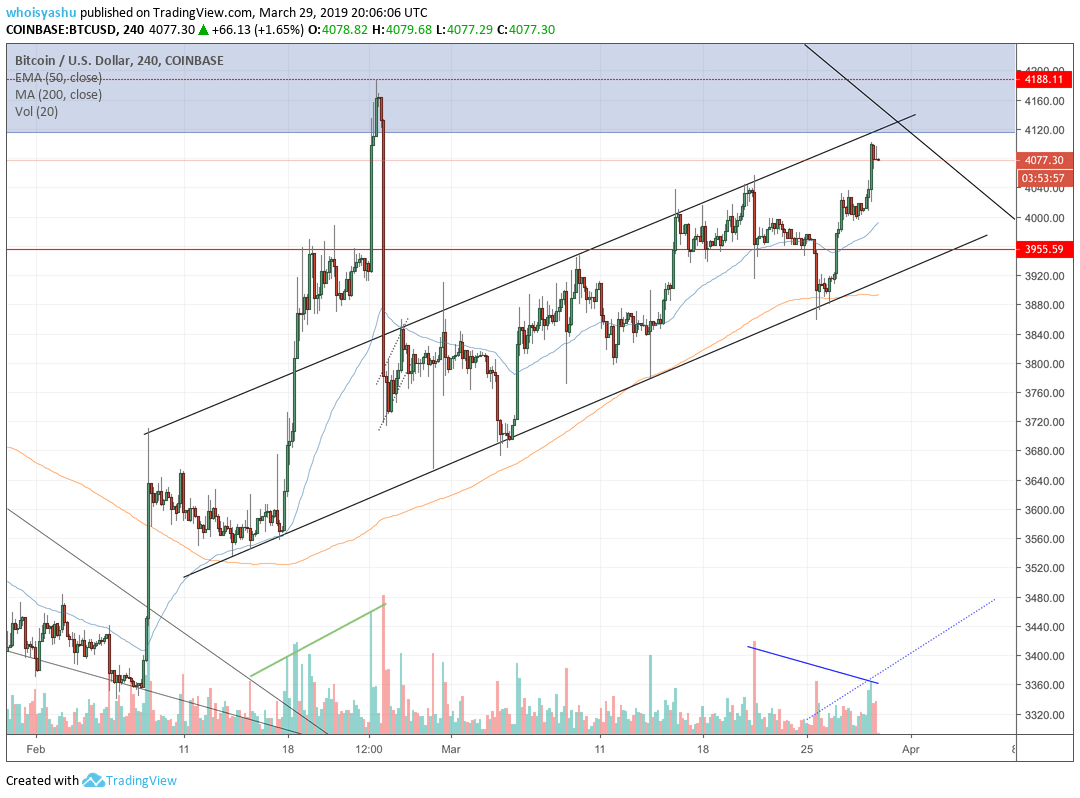

For the seventh time since February 8, the bitcoin price is testing the resistance trendline of its ascending channel formation. The pair historically failed to pierce through the said barrier six times. The only time bitcoin broke that resistance was February 18, which resulted in a massive breakout action towards $4,188. The volume during that breakout also surged with the price in unison (indicated via an ascending green trendline).

The price action we are noticing right now is more similar to those five cases in which bitcoin failed to establish a breakout. A violet trendline in the chart above shows how the volume levels are no higher than the levels witnessed during those failed breakout attempts.

While the bitcoin price action today was impressive, it should not be considered as a bullish bias validator – not unless the volume at least rises like the green ascending trendline.

Charting an Intraday Strategy

We are long towards the ascending channel formation since March 26. It is likely we exit our position on a small profit as bitcoin hints a reversal (red candle formation coupled with a rise in volume) at the channel resistance.

If the selling action persists, we’ll open a new short order towards $3,955 while maintaining a stop loss order 1-pip above the local session high.

If upside action extends, we’ll open a long order towards $4,188 with a stop loss 1-pip below the local swing low, minimizing our risks.