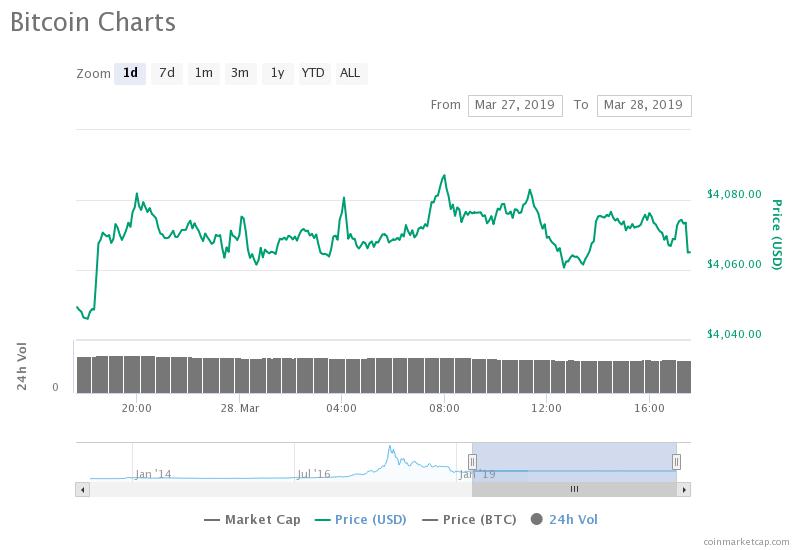

In the past 48 hours, the valuation of the crypto market has increased by $6 billion from $136 billion to $142 billion, accompanied by the strengthening momentum of bitcoin.

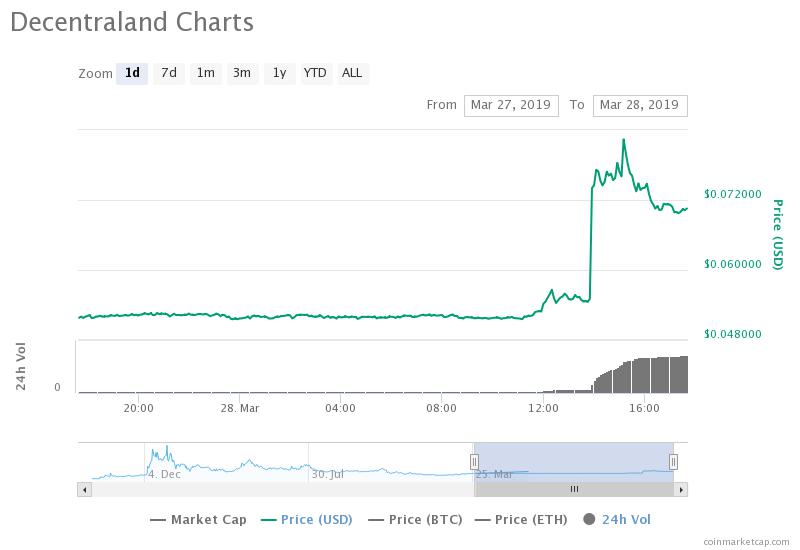

A token called Mana recorded a 36 percent gain against the U.S. dollar within several hours (Source: Coinmarketcap.com)

Tokens and low market cap crypto assets have continued to demonstrate strong gains against both bitcoin and the U.S. dollar, with Decentraland (MANA) recording a gain of over 34 percent on the day.

However, despite the strong performance of crypto assets and the stability of bitcoin at $4,000, one cryptocurrency trader sees bitcoin dropping to $3,000.

Why Back to $3,000 For Bitcoin?

According to one cryptocurrency trader, even if bitcoin hits the $4,200 resistance level, which has been widely considered as a key level for the dominant cryptocurrency to break out of, it is vulnerable to a drop to the low $3,000 region.

In December 2018, bitcoin achieved a 12-month low at $3,122, following a near 50 percent drop from $6,300.

The trader said:

BTC just doesn’t want to dump (yet), which indicates that $4,200 swing high from Feb. needs to be cleared first before it dumps. Ideally this should happen around the 5th-8th of next month where BTC tends to reverse its trend.

Similarly, technical analysts who remain optimistic on the short-term trend of the cryptocurrency market have said that bitcoin is at risk of dropping below the $4,000 mark even if the rest of the crypto market performs well in the weeks to come.

Decent chance we just saw that “one more leg up.”

I greatly reduced exposure up here above $4k. Waiting for 35XX for long entries. I’d love an opportunity to short 41XX, but not sure if we’ll see it.

— The Crypto Dog📈 (@TheCryptoDog) March 21, 2019

The forecast of bitcoin dropping to the $3,500 region by a technical analyst known as “The Crypto Dog” is noteworthy because the analyst has been consistent on the positive trend of alternative cryptocurrencies throughout March.

“I don’t know exactly what is going to happen (of course I don’t, I’m not a wizard), but this doesn’t seem like a typical dump at all. Yes – everything certainly could collapse into fire in the next hour, but my gut says we go up from here. Alternative cryptocurrencies looking bullish,” the analyst said.

Historically, the cryptocurrency market has relied on the short-term price trend of bitcoin and has shown intensified movements on both directions based on the price movement of bitcoin.

Hence, when bitcoin surges, alternative cryptocurrencies tend to show intensified movements to the upside and when bitcoin drops, alternative cryptocurrencies tend to plunge by large margins.

At this phase of the 15-month bear market wherein traders generally foresee the last legs of the correction being established, many analysts remain cautiously optimistic on the trend of the crypto market and are gearing bearish towards bitcoin.

But, not all traders are disregarding the possibility of bitcoin continuing to climb to the $5,000 to $6,000 range, especially if the asset can surpass a key resistance level at $4,400.

Rate my creek, please, took me ages.$BTC pic.twitter.com/7WJV9tyE6c

— C2M ₿ (@C2Mkillmex) March 27, 2019

Previously, a trader known as DonAlt said that if bitcoin breaks out of $4,600, a bullish market structure could be established.

He said:

Volume isn’t what will convince me that the bear market is over, a bullish market structure along with a break of at least $4.6k (Favorably $6k) is. It’s interesting that we’ve had so many altcoin pumps while the general market cap hasn’t really changed. That makes me think there is very little new money coming in.

Tokens Flying Left and Right

Earlier this month, some traders have suggested that the strength of alternative cryptocurrencies allowed bitcoin to avoid a further drop below the $3,500 mark.

In the past 24 hours, tokens in the likes of Decentraland, Ravencoin, Waltonchain, Aion, Tezos, and Chainlink have recorded gains in the range of 5 to 40 percent.

If tokens and low market cap crypto assets continue to demonstrate large gains, moving back to November levels when bitcoin stable in the range of $6,300 to $6,500, it could alleviate some of the pressure on the cryptocurrency market at least in the short-term.

Click here for a real-time bitcoin price chart.