The IPO dreams of Bitcoin mining equipment giant Bitmain are over, at least for now, as its listing application which was filed on September 26, 2018 has reached the six-month expiration date. Without giving a specific date Bitmain, however, said in a blog post that it will reapply at a future date.

The crypto mining hardware maker had intended to raise $3 billion from the IPO at the Hong Kong Stock Exchange (HKEX), per the Financial Times. Bitmain did not, however, clarify whether it will still seek to list on the Hong Kong Stock Exchange or elsewhere.

Did Hong Kong Stock Exchange Know Bitmain’s IPO Application was DOA from the Start?

The fact that Bitmain’s listing application has expired does not come as a surprise though. In December reports emerged that the HKEX was hesitant to approve Bitmain’s IPO application. This hesitance was attributed to concerns over the sustainability of the business. HKEX was especially worried about the possibility of listing a cryptocurrency firm only for it to collapse due to the wild volatility experienced in the sector.

Earlier this year HKEX’s CEO, Charles Li Xiaojia, echoed those concerns urging consistency in the business models of cryptocurrency firms. By then Bitmain had already announced intentions to diversify into Artificial Intelligence and other technology niches.

‘Be Sustainable’: Hong Kong Stock Exchange CEO Scoffs at Crypto Giant Bitmain’s IPO Attempt https://t.co/1weg5JysDz

— CCN.com (@CCNMarkets) January 24, 2019

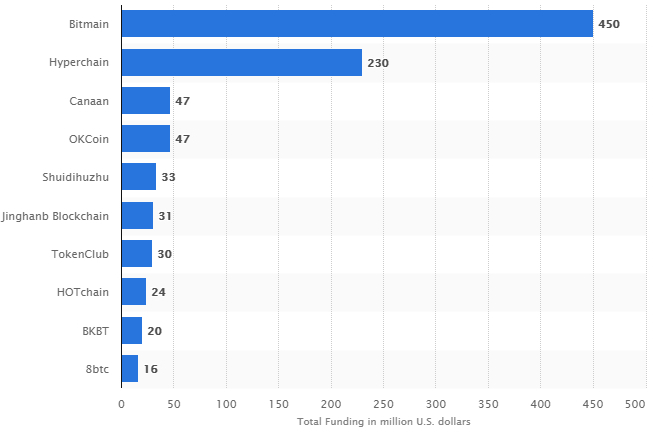

Other crypto-related businesses that have met the same fate includes Bitmain’s Chinese rival Canaan Creative. Bitmain’s expiration of a listing application is significant though because it remains one of the best-funded Chinese blockchain startups.

In the blog post, Bitmain also confirmed management changes that had been reported earlier. Though they will be retained as directors, JIhan Wu and Micree Zhan have stepped down as co-CEOs. Chip industry veteran, Haichao Wang is now the CEO. From the now-expired IPO filing Wu’s stake in the firm was 21 percent while Zhan’s was 37%.

Will Bitmain’s new Miners Make a Difference?

Due to the bearish environment that has persisted in the cryptocurrency space for over a year now, it has become imperative to keep mining costs down. In this regard, Bitmain recently released Antminer Z11 which is based on the 12nm ASIC design. The crypto mining hardware manufacturer claims that the chip uses 28.6 percent less energy.

It remains to be seen whether the Antminer Z11 will resuscitate interest in Bitmain’s mining equipment. Last year in the third quarter an update in it’s public listing application revealed that it made a loss of $500 million. This was attributed to reduced demand for mining rigs, Bitmain’s main product.

Will Diversifying into Artificial Intelligence Save the Day?

Bitmain also indicated in the same blog post that it is still intent on growing its artificial intelligence business. This segment is however yet to make a dent in the company’s revenues, according to South China Morning Post.

Per the IPO prospectus, non-crypto-related businesses brought in only 0.1 percent of Bitmain’s $2.8 billion revenue in 2018’s first half. Analysts are thus of the opinion that the hardware maker’s future hinges on how focused it remains on its core business.

The co-founder of Hong Kong-based crypto investment firm Kenetic Capital, Jehan Chu, told the SCMP:

The real driver to Bitmain’s recovery will be their renewed focus on the core business of designing and producing leading edge mining hardware and also the ongoing institutional investment in crypto and blockchain.