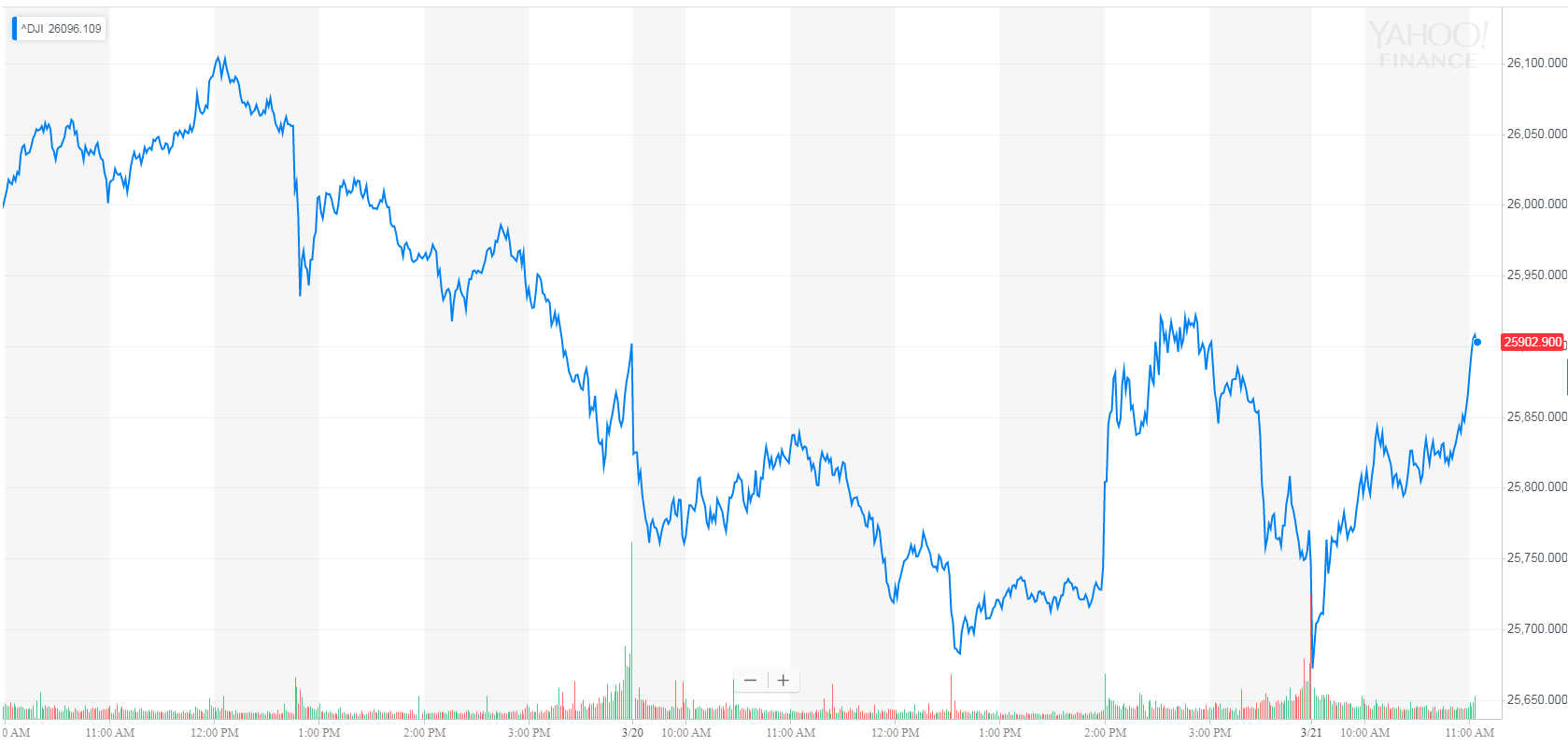

The Dow and broader U.S. stock market pivoted higher Thursday, as traders reassessed the Federal Reserve’s dovish policy turn and its implications on riskier assets.

Dow Rises from the Ashes; S&P 500 & Nasdaq Follow

Wall Street’s major indexes overcame a volatile start to trade sharply higher on Thursday. The Dow Jones Industrial Average surged 158 points, or 0.6%, to 25,904.43. The blue-chip index had opened in negative territory, reflecting a volatile pre-market for Dow futures.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Apple Inc. (AAPL) was the Dow’s best performer, climbing 3.3%. Shares of DowDuPont (DWDP) gained 2.3%.

The broad S&P 500 Index of large-cap stocks climbed 0.7% to 2,842.85. Nine of 11 primary sectors reported gains, with information technology rising 1.7%. Materials stocks also outperformed the market, gaining 0.9%.

Surging tech shares powered the Nasdaq Composite Index to big gains. The tech-driven benchmark rallied 1% to 7,806.57.

The CBOE Volatility Index, also known as the VIX, was little changed Thursday. It last traded at 13.87 on a scale of 1-100 where 20-25 represents the historic mean.

Fed Signals No Rate Hike in 2019

The Federal Reserve’s policy-setting board on Wednesday voted unanimously to keep interest rates on hold and signaled that additional hikes are unlikely this year. The announcement sent bank shares tumbling but seems to have sparked a broader rally for other risk assets.

By removing any expectation of a rate hike in 2019, central bankers downgraded their outlook on the economy and sounded alarm bells on inflation.

“It may be some time before the outlook for jobs and inflation calls clearly for a change in policy,” Fed Chairman Jerome Powell said at a news conference after the two-day meeting.

The central bank now sees the economy growing just 2.1% this year, down from a previous forecast of 2.3%. The downgrade mirrors a depressed outlook on the global economy, which has seen multiple downward revisions from the International Monetary Fund, World Bank, and Organization of Economic Cooperation and Development.

A slowing domestic economy puts more pressure on the Trump administration to finalize a trade agreement with China. Both sides are set to return to the negotiating table next week in Beijing, with President Trump sending his top trade brass to Beijing to meet with Vice Premier Liu He. A Chinese delegate is expected to make a return trip to Washington, D.C. the following week.