The US stock market looks set to open to sharp losses, as Dow futures are trading deeply in the red in response to a new comment from President Donald Trump that cast doubt on his ability to strike a comprehensive trade deal with China within the near future.

Dow Futures Signal Triple-Digit Plunge

As of 8:55 am ET, Dow Jones Industrial Average futures had pared earlier losses but still lost 90 points or 0.35 percent, implying an opening bell plunge of 137.67 points. S&P 500 futures lost 9.5 points or 0.34 percent, and Nasdaq futures shed 29.25 points or 0.39 percent as the US stock market prepared to take another step down at the open.

Dow futures pointed to losses of more than 100 points at the open. | Source: Yahoo Finance

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

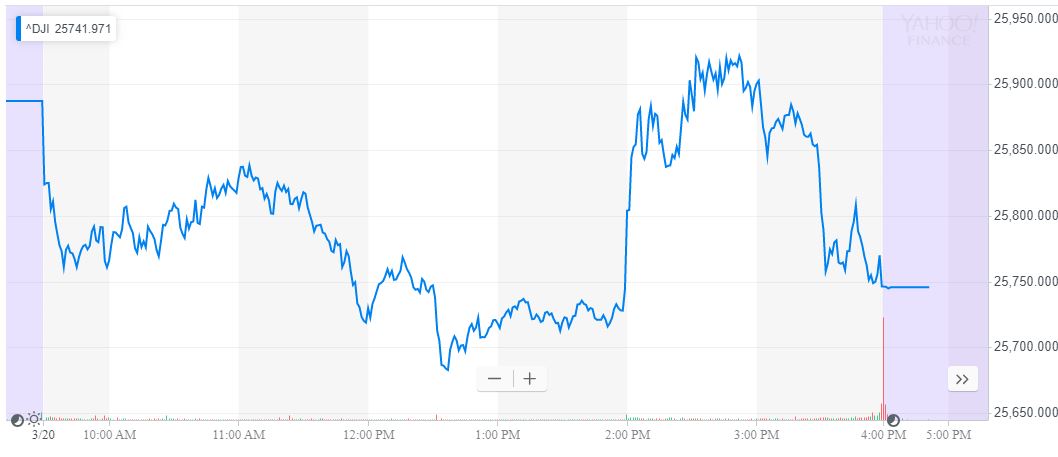

On Wednesday, the Dow see-sawed its way to a 141.71 point decline, closing at 25,745.67 for a loss of 0.55 percent. The S&P 500 also ended the day in the red, losing 8.34 points or 0.29 percent to close at 2,824.23. The Nasdaq, meanwhile, resisted the bearish trend and crept up to 7,728.97 for a gain of 5.02 points or 0.07 percent.

A volatile Dow ended Wednesday’s trading session more than 140 points in the red. | Source: Yahoo Finance

Not even a wildly-dovish FOMC statement was enough to rescue the Dow. While Wall Street expected the Federal Reserve to hold rates steady, Chair Jerome Powell exceeded even those predictions by announcing that the Fed was unlikely to raise rates for the remainder of 2019, despite earlier forecasting as many as two rate hikes before the end of the year. The policy statement gave the stock market an immediate bounce, but the Dow ultimately reversed that recovery just before the closing bell rang.

Trump Trade War Bombshell Bites at Dow Futures

This morning, the index faces added pressure from Donald Trump who dropped a major bombshell when he revealed that the US does not intend to eliminate tariffs on Chinese goods as part of a comprehensive US-China trade deal.

“We’re not talking about removing [tariffs], we’re talking about leaving them for a substantial period of time, because we have to make sure that if we do the deal with China that China lives by the deal,” Trump told reporters outside the White House.

Refusing to include tariff reductions as a bargaining chip would seemingly lessen the likelihood of reaching a new trade deal within the near future, especially as China reportedly walks back key trade concessions, such as canceling orders for the embattled Boeing 737 MAX 8.

China has reportedly backed out of tentative agreement to purchase more Boeing 737 MAX 8s to help the US reduce its trade deficit. | Source: STEPHEN BRASHEAR / GETTY IMAGES NORTH AMERICA / AFP

Maintaining tariffs on Chinese goods would also ensure that whatever deal the two economic superpowers arrive at does not provide a clean break to the trade war, leaving US companies weighed down by retaliatory tariffs on both sides of the Pacific.

Still, numerous reports have indicated that Trump evaluates his economic policies based on how they influence the stock market. If he believes an ongoing tariff regime will harm Wall Street – and by extension his reelection chances – he could soften that stance as negotiators hammer out a formal draft agreement.

For his part, President Trump brushed off concerns that maintaining tariffs on Chinese imports would roil the trade negotiations.

“President Xi [Jinping] is a friend of mine,” Trump told reporters. “The deal is coming along nicely. We have our top representatives going there this weekend to further the deal.”

Judging by Dow futures prices this morning, traders aren’t quite so confident.