A draft legislation in Australia is seeking to prohibit the use of cash in making transactions for amounts exceeding $AUD10,000 ($6,900) has spared cryptocurrencies. The goal of imposing the cash payment limit is to prevent tax evasion, money laundering and other illicit activities.

Among the reasons the Australian government has given regarding the decision to exclude crypto from the cash payment limit includes the fact that little evidence has been found showing the use of cryptocurrency in ‘black economy activities’.

Australia – Exposure draft legislation for an economy-wide cash payment limit of $10,000 https://t.co/CCGd0qgyov pic.twitter.com/0gYG7AUwqk

— AML Sanctions (@AMLsanctions) July 26, 2019

Additionally, the Australian government has said that imposing the cash payment limit on crypto may stifle invocation in the digital currency space or discourage the use of crypto in the country. However, this could change in the future with the Australian government promising to make a regular assessment with a view of changing the position when it becomes necessary.

Not happy with the cash payment limit? Say it before August 15

The draft law seeking to restrict the use of cash is currently in the public consultation phase until mid-next month. The proposed legislation was announced in the 2018-19 budget and seeks to ensure that transactions of amounts exceeding $AUD10,000 are done by check or via an electronic payment system. It is expected to become law starting next year.

Though cryptocurrencies have been exempted from the cash payments limit, it does not in any way mean that they will be used in a regulatory vacuum in Australia. Last year the country’s anti-money laundering and counter-terrorism financing regulator, the Australia Transaction Reports and Analysis Center (AUSTRAC) introduced new laws specifically aimed at cryptocurrency exchanges. Among other requirements, crypto exchanges in Australia have to be registered with AUSTRAC.

Australian Crypto exchanges risk suspension for non-compliance

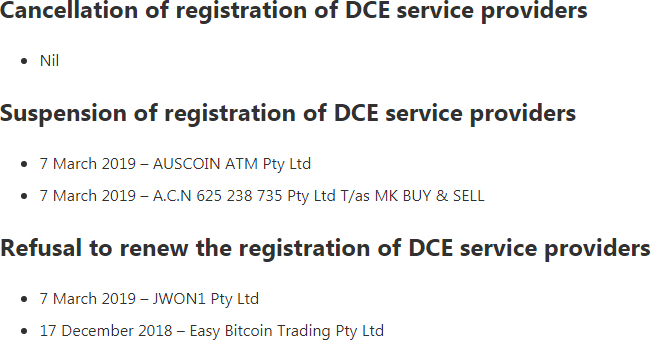

The exchanges are also required to comply with the country’s anti-money laundering and counter-terrorism financing regulations. While AUSTRAC has not canceled the license of any crypto exchange since the laws came into being, in the last eight months it has suspended the registration or refused to renew the registration of some digital currency exchanges citing an ‘unacceptable risk of money laundering, terrorism financing, or other serious crime’

Inevitably, Australia’s move to limit the use of cash in large transactions will reduce the amount of cash in circulation. And whether by design or not, this could push the country into launching a digital currency like other countries with low cash usage rates are planning to.

Sweden’s national bank Riksbank has, for instance, stated that its decision to develop the e-krona was driven by the declining use of cash in the Scandinavian country. In the long run, this could benefit the crypto space as it will further demystify cryptocurrencies and enhance innovation.