By CCN: The ongoing bitcoin price rally has more than enough fuel to retest the all-time high of $20,000, according to Andy Cheung, head of operations at Malta-based cryptocurrency exchange OKEx. Cheung called $20,000 a “conservative prediction,” hinting that most speculators are less likely to exit their long positions now that BTC has already rebounded by more than 180% from its low near $3,120 in just 163 days.

“$20,000 is a conservative prediction for [the] bitcoin price in 2019, as I said last year. The rally won’t stop here because more institutional investors are coming into the market, and the 2020 halving effect starts to take place. We are thrilled to witness such [a] bullish trend, and I look forward to a new high the bitcoin deserves. Bitcoin is not just a coin but a spirit that hinders the crypto-industry.”

Trying to get them to accept BTC or other cryptocurrency instead of being a Fiat only Cafe :p pic.twitter.com/b7SEJh347E

— Andy Cheung OKEx (@AndyC0125) May 17, 2019

Holding Sentiment Rising

Cheung’s statements closely followed bitcoin’s Monday rally in which the asset established a fresh 2019 high just shy of $9,000. That took bitcoin’s gains this year to more than 140%, including a 120% jump in the last two months. The profits were reminiscent of some of the most significant benefits seen during the bitcoin price boom in December 2017. Back then, it took the cryptocurrency only 10 days to achieve $20,000 as its all-time high after it closed above $8,300.

But the dynamics surrounding the previous boom are very different from that in the current one. Q4 2017 saw bitcoin surging close to 219% owing to the infamous ICO mania. People purchased BTC not to hold but to buy tokens issued by then-emerging blockchain startups. When 90% of those firms failed, they likely sold the bitcoins they had crowdfunded and caused the asset to crash by more than 75% ahead of 2018’s close.

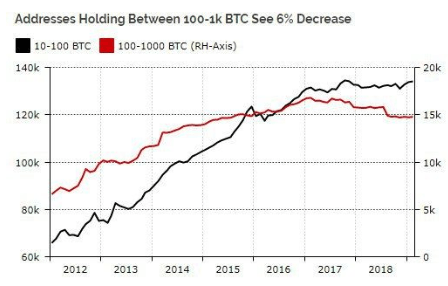

Nevertheless, in Q2 2019, investors are purchasing BTC to hold rather than give away for other assets. Diar, an institutional publication, reported in February that the number of bitcoin holders — investors who did not move the cryptocurrency from their hot/cold wallets – was increasing.

Diar noted that the number of wallets holding anywhere between 100 and 1,000 BTC was declining. However, that could also be due to fund distribution.

1 Million New Bitcoin Holders Every Month

In another study, Wences Casares, CEO Hong Kong-based bitcoin wallet company Xapo, stated that 60 million wallets are holding the cryptocurrency:

“After 10 years of working well without interruption, with more than 60 million holders, adding more than 1 million new holders per month and moving more than $1 billion per day worldwide, [bitcoin] has a good chance of succeeding.

Bitcoin adoption is roughly tracking the trend for internet adoption. I made this in 2014, predicting 500M holders by 2020. @Wences estimates that we’re currently at 60M Bitcoin holders. pic.twitter.com/Z75MRWGBPh

— Tuur Demeester (@TuurDemeester) April 13, 2019

The statistics suggest that some bitcoin traders are waiting for big whales (institutional investors) to drive the bitcoin price action toward $20,000 — just as Cheung predicted.