By CCN: When the whales start splashing, you can be sure that a major Bitcoin market move is afoot. New research reveals that these high-rolling crypto investors accumulated a staggering 450,000 BTC over the past nine months, especially as the market careened toward its bear market lows in late 2018.

In other words, the whales bought the freaking dip. And now they’re riding the bull market tidal wave all the way to the bank.

Diar: Whales Own 1/4 of All BTC – And They’re Buying More

According to the latest issue of Diar, more than one-fourth of all Bitcoin funds are held in “whale” wallets with more than 1,000 BTC each. The research article correlates the increase in significant holdings with the last time Bitcoin was at its current price (last August) and points out that addresses holding this level of coin have increased to over 26% of the circulating BTC supply.

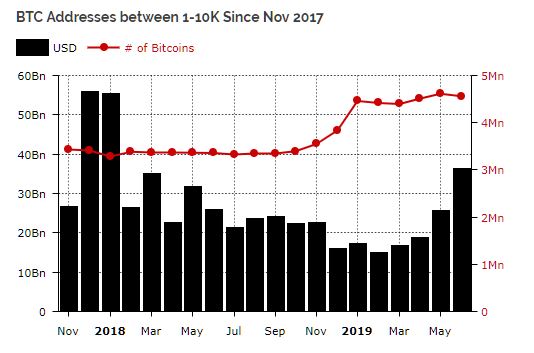

The analysis excludes Coinbase-controlled addresses because the US crypto exchange giant created a number of these “whale wallets” when it massively reorganized its cold storage system. If it had included them, then more than 1.2 million BTC would rest in addresses with between 1,000 and 10,000 BTC each. Instead, about 450,000 BTC have entered these semi-active accounts within the last nine months, with major accumulation taking place at the bottom of the bear market in December.

Private, non-institutional investors have been accumulating Bitcoin like nobody’s business, and “hodling” it – but not on crypto exchanges. Diar writes:

“Bitcoins held by major addresses – mostly of which are exchanges – have seen an exodus of over 300K Bitcoins since the start of 2018. At peak, these addresses held 750,000 more Bitcoins than they do today, 21% of the total circulating supply versus 16% today.”

Diar previously reported that over 50% of all BTC had never moved. Many of these addresses maintain these high balances because they rarely spend their funds. As such, the current trend appears to be accumulation. Tuur Demeester’s Adamant Capital released a report earlier this year that reached the same conclusion.

Will Bitcoin Go Beyond $20,000 This Time?

The Bitcoin price’s mammoth ascent has correlated with rabid whale activity. | Source: Yahoo Finance

If the amount of coin held in this class of addresses is any indicator, then the price could go higher than it previously did. With such a large number of people firmly not selling so many coins, those looking to get into Bitcoin will pay higher and higher prices to do so. The real liquidity of the Bitcoin market gets harder to determine as a result: If a mass exodus were ever to take place, where would the bottom be?

Researchers have also argued that whales present no threat to the health of the Bitcoin economy. Beyond the persistent existential threat posed by a small number of people controlling large piles of the cryptocurrency, a quick study of the market’s history shows us that most hodlers continue to hold. Even during the heady days of $18,000 and beyond, many crypto investors failed to move a single coin.

This brings up another important point: There is a group of people who bought into BTC on the way up to $20,000 and refuse to sell at a loss. Many of these people may be considered “involuntary” hodlers who will continue to put sell pressure on the market until we see prices beyond the previous highs. Some of them may have developed philosophical leanings that keep them in the game in the meantime.

A significant portion of new money entering this market belongs to people looking to speculate and earn on the “buy low, sell high” strategy. The volatility of the crypto market is such that often enough, the “high” doesn’t come within a reasonable window. Other times it happens so fast, the virgin crypto trader chooses not to sell because the market could yield even higher prices.