By CCN: China Electronic Information Industry Development (CCID), an agency that works directly under the Ministry of Industry and Information Technology, has released its newest crypto rankings, which saw bitcoin climb up to 12th from 15th.

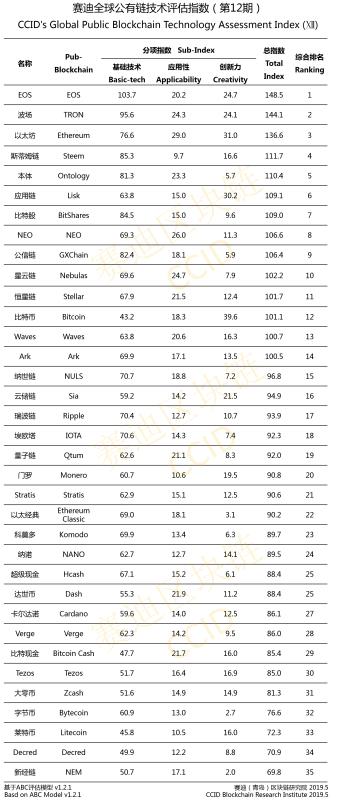

In March, CCID ranked bitcoin, the most dominant crypto asset in the global market, at 15th while placing EOS as the top blockchain protocol in terms of applicability and creativity. EOS and TRON, two scalability-focused blockchain networks with large transaction capacity, have topped CCID’s crypto rankings once again.

Why did bitcoin climb up?

The crypto rankings of CCID prioritizes applicability and creativity over security and decentralization, which by default would favor large capacity blockchain networks over proof-of-work blockchain networks that are primarily utilized as settlement networks for payments.

In its May report, CCID emphasized that the criteria used to evaluate blockchain protocols have not changed, with basic technology, application, and innovation as three main criterions.

“The subject of this technical assessment has not changed, including 35 well-known public chains around the world. The evaluation model is consistent with the previous issue and is still evaluated in three main areas: basic technology, application and innovation,” the document released by CCID read.

Bitcoin has consistently ranked the highest for creativity on CCID’s rankings, most likely because it is the first crypto asset to ever exist and to pave the pathway for other blockchain protocols to emerge.

In May, CCID awarded bitcoin with 39.6 points in creativity, significantly higher than ethereum, which came as a second at 31 points.

Bitcoin has climbed up the rankings primarily due to its active open-source developer community and the release of the 0.18.0 version of Bitcoin Core.

The CCID report read:

The data shows that in the past month, 35 code updates for the public chain have been continued, and several public chains have released heavyweight main network updates. Bitcoin officially released the 0.18.0 version of the client, involving updates to multiple wallet interaction features.

Since March, the bitcoin price has also increased from around $4,000 to nearly $9,000, by more than two-fold. Year-to-date, bitcoin is up 135 percent against the U.S. dollar, outperforming most traditional assets and indices.

Bitcoin is expected to go through a block reward halving in May 2020, a mechanism that decreases the rate in which new BTC is generated by miners. Historically, a halving has led to an increase in price a year before and after it occurs.

Although it remains unclear whether bitcoin would be able to rank higher up in CCID’s rankings given the agency’s current criteria, a noticeable increase in usage and user base triggered by an increase in price could potentially see bitcoin rank higher in applicability in the medium-term.

Is EOS and TRON unbeatable on ccid’s rankings?

Developers such as Gnosis product developer Eric Conner have long expressed concerns regarding the reliability of decentralized application (DApp) usage metrics for all smart contract protocols.

“Obsessing over dapp usage metrics right now is silly. We all know scaling and UX needs to improve before those numbers rise. The argument used to be that building the dapp itself was impossible. That’s been destroyed at this point and that’s what matters in 2018,” Conner previously said.

Last month, Conner particularly singled out EOS and TRON DApp usage metrics, stating that DApp user data is unreliable at its current form.

But, as long as CCID prioritizes applicability, which would favor scalability and large capacity over other important characteristics of a decentralized blockchain network, smart contract protocols like EOS, TRON, Ethereum, and potentially proof-of-stake protocols are likely to rank highly.