By CCN: In the last 24 hours, the bitcoin price has dropped by around four percent against the U.S. dollar, leading major crypto assets such as ethereum, bitcoin cash, and XRP to drop by more than seven percent.

The anticipated pullback of both bitcoin and the rest of the crypto market comes after technical analysts like Josh Rager suggested that a healthy bitcoin pullback is likely due coming off a powerful 110 percent year-to-date gain.

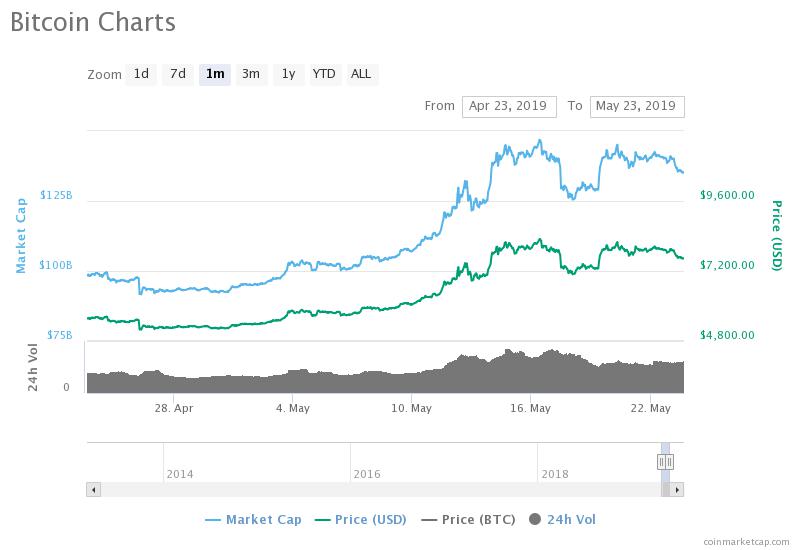

The bitcoin price is up by nearly $3,000 in the past month against the U.S. dollar, outperforming every major index (source: coinmarketcap.com)

“BTC 30%+ pullback coming? Yes, eventually. If history repeats, there should be plenty of strong pullbacks on the way to next peak all-time high. There were at least nine 30%+ pullbacks from last cycle accumulation and uptrend Plenty of buying opportunities ahead, don’t let it shake you,” said Rager.

Overnight, the valuation of the crypto market has declined by around $12 billion from $249 billion to $237 billion.

Will Bitcoin and Crypto Pullback Last Longer?

In the past month, within merely 30 days, the bitcoin price has from $5,100 to $8,000 at its peak, by nearly $3,000. That is, a monthly gain against the U.S. dollar of 56 percent.

On previous occasions wherein bitcoin came off of large short-term gains, the dominant cryptocurrency has tended to correct by 20 to 30 percent.

A 20 to 30 percent correction from $8,000, its 2019 high, would be a drop to the $6,000 to $7,000 region, a range which some technical analysts have highlighted in recent weeks.

#Bitcoin is now 7% ABOVE its logarithmic trend. The last two times this happened… (orange dotted line) pic.twitter.com/v7dW5oYweM

— Awe & Wonder 🌑 (@Awe_andWonder) May 16, 2019

There exists a possibility that the momentum of bitcoin and the noticeably increasing retail interest towards the crypto market, as seen in the Google Trends popularity of bitcoin, prevents a a large drop below key support levels.

Alex Krüger, a global markets analyst, also emphasized that below $7,000, there are many solid support levels bitcoin could rely on to prevent a free fall from its current price range.

$BTC levels

Support: 7600, 7200, 6800, 6400, 6200, 6000, 5750-5500, 5000.

Resistance: 8400-8500, 10000, 11500-11750, 13000, 15000, 17400, 20000, moon.

— Alex Krüger (@krugermacro) May 21, 2019

But, on May 21, Krüger noted that he sees a bearish trend for bitcoin if it drops below $7,600 in the near-term.

Bearish below 7600. Rather focus on adding on dips if it turns lower.

— Alex Krüger (@krugermacro) May 21, 2019

Similarly, a crypto asset trader acknowledged as “Mayne” suggested that a drop below $7,600 could potentially lead the asset to decline below the $7,000 support level.

“BTC – Need to hold $7,884 and red OB for upside target $9k+. Break below red OB I expect $7,300 and maybe lower to $6,400. ETH – USD pair needs to break and close thru $260 to get to $300. BTC pair had a nice reaction of range low if we can hold EQ and flip grey OB looks good,” he said.

What are Potential Catalysts?

A pullback from the current stage of the crypto market movement is widely considered as a healthy step back for bitcoin that could solidify the foundation for the market to initiate a stronger upside movement in the near future.

Mark Yusko, the founder and CEO at Morgan Creek Digital, hinted that the average return of bitcoin over the past five years could appeal to endowments and institutions that have hundreds of billions of dollars in assets under management.

He said:

Some numbers to ponder when thinking about value of adding Bitcoin to your portfolio Endowments have $613B in assets. Average return over past 5 years was mediocre 7.2%. Had they allocated 1% to BTC return would’ve been 9.2%. Had Bitcoin gone to zero, return would’ve been 7%.

A steady inflow of capital from institutions into the crypto market has become a possibility with the emergence of reliable custodial solutions developed by well-regulated companies such as Fidelity and ICE’s Bakkt.

Click here for a real-time bitcoin price chart.