By CCN: The Dow and broader U.S. stock market tumbled on Monday, as the combination of poor economic data, geopolitical tensions and a trade-war standoff with China kept investors out of riskier assets.

Dow Struggles to Gain Footing; S&P 500, Nasdaq Falter

All of Wall Street’s major indexes declined on Monday, mirroring a volatile pre-market session for Dow futures. The Dow Jones Industrial Average fell 121.74 points, or 0.5%, to 25,652.26.

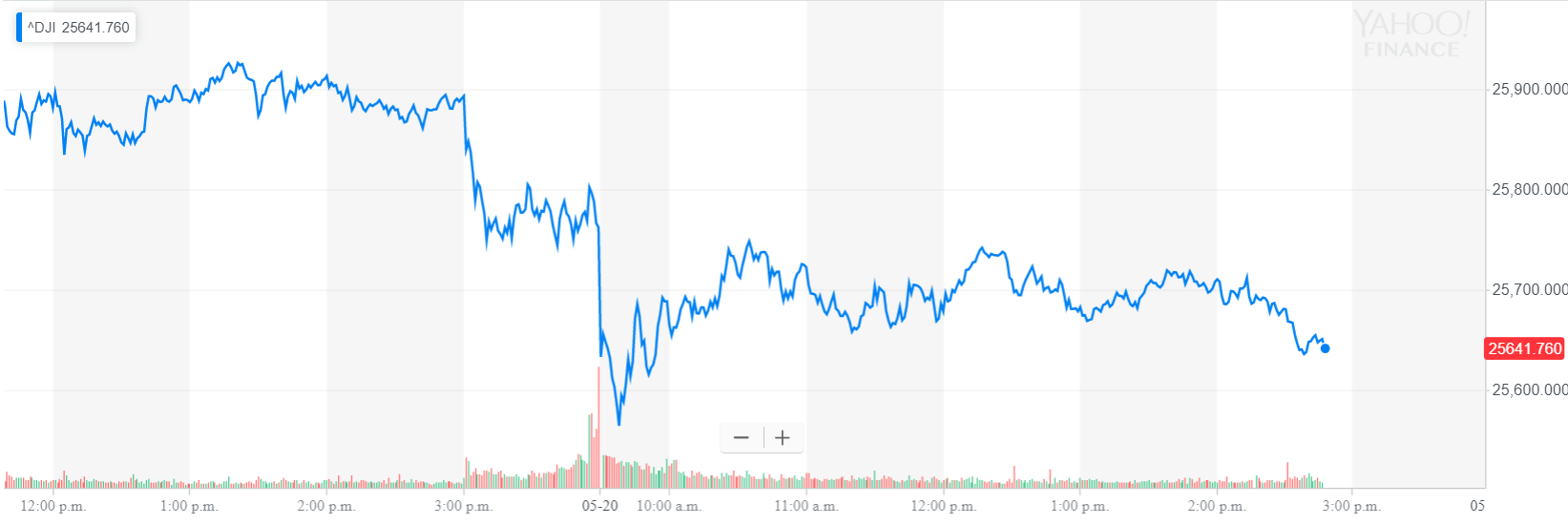

The Dow Jones Industrial Average declined by as much as 214 points on Monday. | Source: Yahoo Finance.

The broad S&P 500 Index of large-cap stocks plunged 0.8% to 2,835.84. Nine of 11 primary sectors retreated, with information technology shouldering the heaviest losses. Four sectors booked losses of 1% or more.

Plunging tech shares weighed heavily on the Nasdaq Composite Index. The technology-focused benchmark fell 1.6% to 7,694.77.

What Economic Miracle?

President Trump’s economic recovery takes a major step back at the start of the second quarter, according to the Chicago Federal Reserve’s National Activity Index. | Source: AP Photo / Tony Gutierrez

President Trump’s “economic miracle” may not be all it’s cracked up to be, according to a closely-watched gauge of the U.S. economy.

The Chicago Federal Reserve’s National Activity Index plunged to -0.45 in April from +0.05 in March on a scale where zero represents historical trend growth. That was the weakest reading since May 2016, roughly eight months before President Trump took office.

The Chicago Fed National Activity Index just crashed to minus .45, its lowest level since May of 2016, 6 months before Trump was elected, and 8 months before he took office. Based on this index not only is the U.S. economy not the best ever, it’s not even the best since 2016!

— Peter Schiff (@PeterSchiff) May 20, 2019

Using the less volatile three-month moving average, the National Activity Index fell to -0.32 in April from -0.24 in March.

The monthly indicator tracks economic conditions across the U.S. economy using 85 indicators. During the month of April, 52 indicators declined compared with 33 that made positive contributions.

U.S. gross domestic product (GDP) expanded at a much faster than expected 3.2% annual pace the first quarter. But beneath the surface, the U.S. economic recovery faces a multitude of risks, including a prolonged trade war with China, a shaky real estate market, and soft manufacturing activity.

Last week, U.S. government data showed unexpected declines in retail sales and industrial production for the month of April.

Retail sales are used to gauge consumer spending habits, a component of the market that accounts for more than two-thirds of GDP.

Click here for a real-time Dow Jones Industrial Average price chart.