By CCN.com: Forty percent of senior finance executives expect their firms to invest in blockchain technology over the next two years, according to a recent survey by audit firm Grant Thornton LLP. That’s in addition to the 22 percent who report their firms have already implemented the technology.

This marks a dramatic change from only a year ago, when blockchain was more talked about than practiced, according to Chris Stephenson, Business Consulting principal at Grant Thornton LLP and author of the report.

In its 2019 CFO Survey, Grant Thornton along with partner CFO Research surveyed 378 senior finance executives in companies with revenues between $100 million to $20 billion. Most of these are headquartered in the U.S.

TIME TO INVEST OR BE LEFT BEHIND

Surpassing the 14% to 17% range (for implementation) is a significant threshold, one that investors take seriously because it signals that the technology has moved beyond the ‘early adopters’ stage and into the mainstream. It’s time to invest or be left behind, Stephenson tells CCN.

Grant Thornton didn’t even ask about blockchain in its earlier, 2018 CFO Survey. It was buried within the distributed ledger technology (DLT) group — blockchain is a subset of DLT. The degree of blockchain implementation reported in the 2019 survey was unexpected — “stunning” — Stephenson adds.

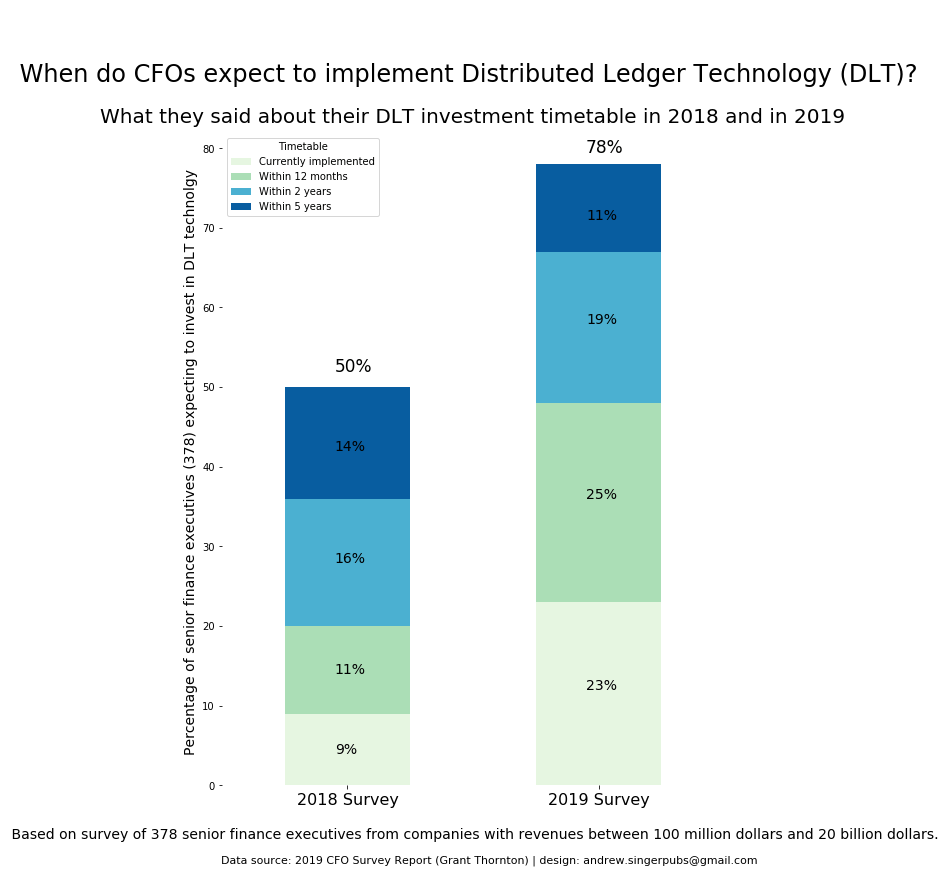

DLT and blockchain technologies are similar, of course, so it can be instructive to compare 2018 and 2019 survey results with respect to DLT:

In 2018, only 9 percent of the 304 senior financial leaders surveyed said their firms had implemented DLT, but one year later, in 2019, 23 percent surveyed said DLT had been implemented in their companies.

Surpassing predictions

It’s rare in annual surveys that outcomes surpass predictions, but this was the case with DLT. In 2018, 11% of CFOs “predicted” their companies would adopt DLT ‘within the next 12 months.’ In point of fact, 14% implemented DLT the following year.

How to explain this speed of DLT/blockchain acceptance? A drop in technology costs could be a factor. Also, many new implementations are pilot programs, not fully rolled-out programs. It probably helps, too, that software providers like Microsoft have been offering blockchain solutions on the cloud (e.g., Azure). That said, “We’re still scratching our heads” over the results, says Stephenson.

A year ago, 50% of finance executives expected to be using DLT at their companies within the next five years; in the 2019 CFO survey, 78% anticipated DLT within five years. Seventy-two percent expect to be using blockchain within five years.

DLT and blockchain – there is a difference

The two terms are often used interchangeably — sometimes deliberately by banks, say, looking to distance themselves from the volatile crypto markets. But they are different. Blockchain technology is generally more open from a ‘permission’ standpoint. DLT is more private, and not all parties may have access to all the records.

Blockchain is the fastest emerging technology within DLT, notes Stepheson, “and those who understand blockchain will have a field day over the next five years.” His own firm has two blockchain pilot programs in the works. Yes, the terms are often used interchangeably, “but moving ahead there will be more understanding of the differences.”

In terms of adoption by sector, many of the early blockchain implementations have been in the financial services industry, not surprising given that that industry is most at risk for disruption, Stephenson notes. Healthcare and supply chain companies have also been early adopters.

The study highlights the role of the corporate CFO as a driver of digital change. The CFO is his/her company’s “steward of data,” says Stephenson, and it behoves a CFO to know something about blockchain and DLT technologies which are so data-driven. “These are technologies that the CFO and CIO will have to quarterback together,” he added.

About the Author: Andrew W. Singer is an independent data journalist based in New York City. He obtained a Master’s degree in statistics from Columbia University in 2017, and worked as an associate instructor in Machine Learning in Columbia’s MS Program in Applied Analytics — where he became interested in blockchain technology.