The crypto market cap has added a staggering $32.62 billion to its valuation in the last two days. And it is not just bitcoin that is leading the pump.

What started as a bitcoin rally later transformed into an altcoin-fest when bitcoin cash and litecoin began to posting winning numbers.

While bitcoin cash surged from $168.50 to as high as $336.62, litecoin ballooned to almost twice its April 2 valuation, rising from $61 to a session high at $94.48.

Together, the world’s fourth and fifth largest cryptocurrencies injected $4.52 billion into the market. That comprised almost 14 percent of the overall crypto pump.

Bitcoin Cash (BCH) Flirts with $400 Resistance Level

The bitcoin cash price extended its upside momentum this Wednesday with a 54.18 percent jump in just 24 hours. As of 18:15 UTC, the pair was trading at $319.06, down 5.5 percent from its intraday high.

Crypto exchanges facilitating BCH-enabled pairs posted an adjusted daily volume of $3.76 billion (based on CMC data), mostly against Tether’s stablecoin USDT, bitcoin, and the South Korean won. On Yahoo Finance, the reported volume was somewhat lower at $228.72 million.

The surge led BCH into an overbought area, according to its daily relative strength index. The momentum indicator was 91 at the time of this writing, awaiting correction. There is a likelihood that it would extend further into the selling area before dropping any lower, the signs of which could be seen in the price action above.

The BCH-to-dollar rate is currently targetting $400-408 as the next potential resistance area. The range earlier reversed BCH bearish momentum on nine separate occasions. The bears were able to break the support line only in the wake of poor fundamentals raised by the hard fork last November. $400 was support for bitcoin cash as much as $6,000 was for bitcoin.

That said, the bitcoin cash price could attempt a push towards or above $400-408 if accompanied by strong volume. A low-volume upside action would likely result in a pullback, taking the price first towards $279.83 – a crucial support from the October 8 session – while viewing the 200-period EMA as a potential downside target.

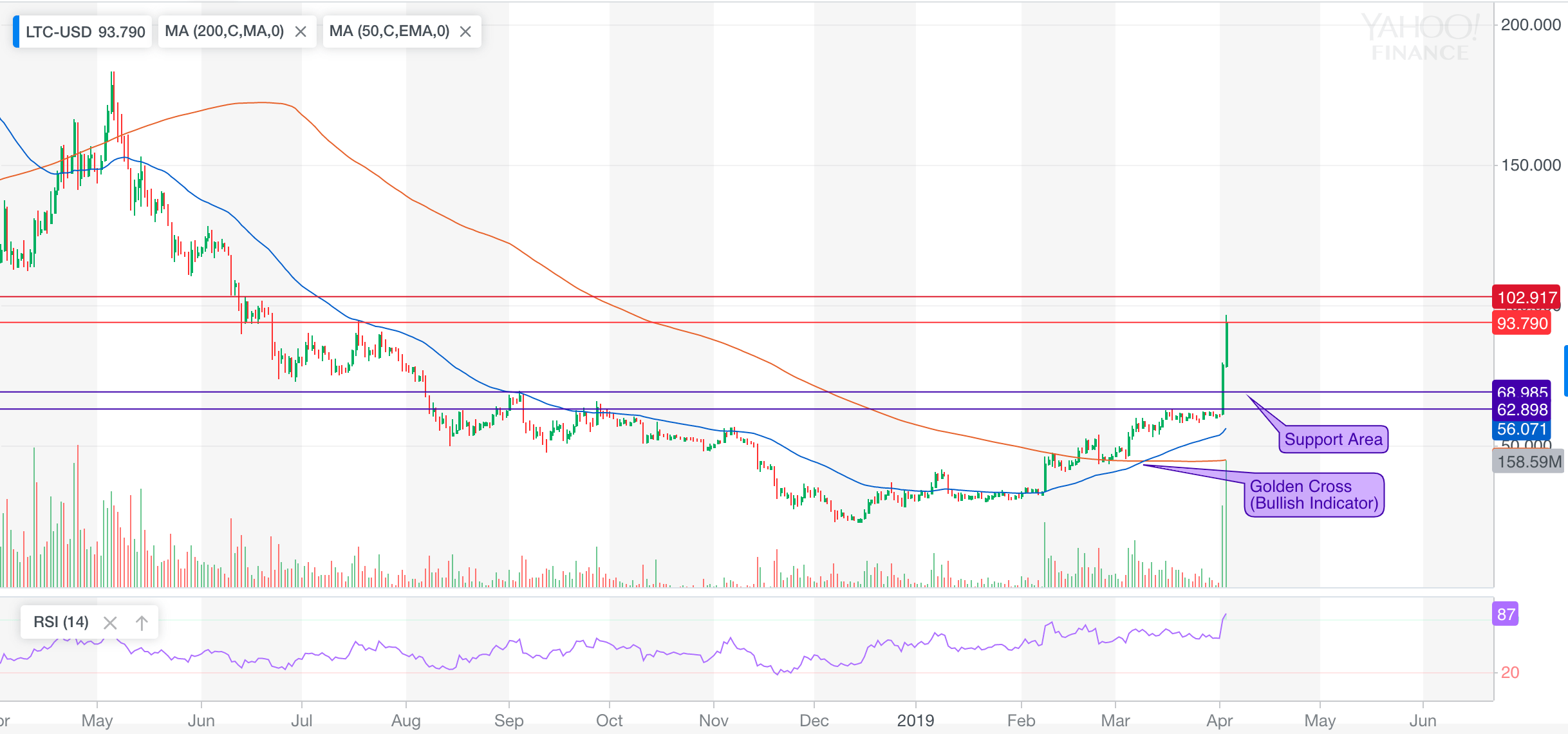

Litecoin (LTC) Price Forms a Bullish Golden Cross

The litecoin-to-dollar rate jumped 31.69 percent, according to a 24-hour adjusted timeframe. As of 18:30 UTC, the pair was trading at $93.77 after correcting 2.3 percent lower from its intraday high.

On CMC, the LTC-enabled pairs noted an adjusted volume worth $5.83 billion. On Yahoo Finance, the reported volume was much lower at $158.59 million.

Like BCH, LTC also entered its overbought RSI area to 87. But unlike BCH, LTC had a crucial technical indicator supporting its upside push. The Golden Cross, an event in which a short-term moving average goes above a long-term moving average, formed on the litecoin chart on March 10. That does not explain why the litecoin price spiked so abruptly, though. All the Golden Cross indicated was an upside push.

As of now, the litecoin price is testing $93.79 as its interim resistance, while setting its upside target towards $102.917. If the pair fails to break above them and pulls back, then the pressure to support the uptrend would fall upon a support area defined by $62.89 and $68.98. They acted as strong resistance during the cryptocurrency’s uptrend.

Disclosure: The author holds bitcoin cash and litecoin.