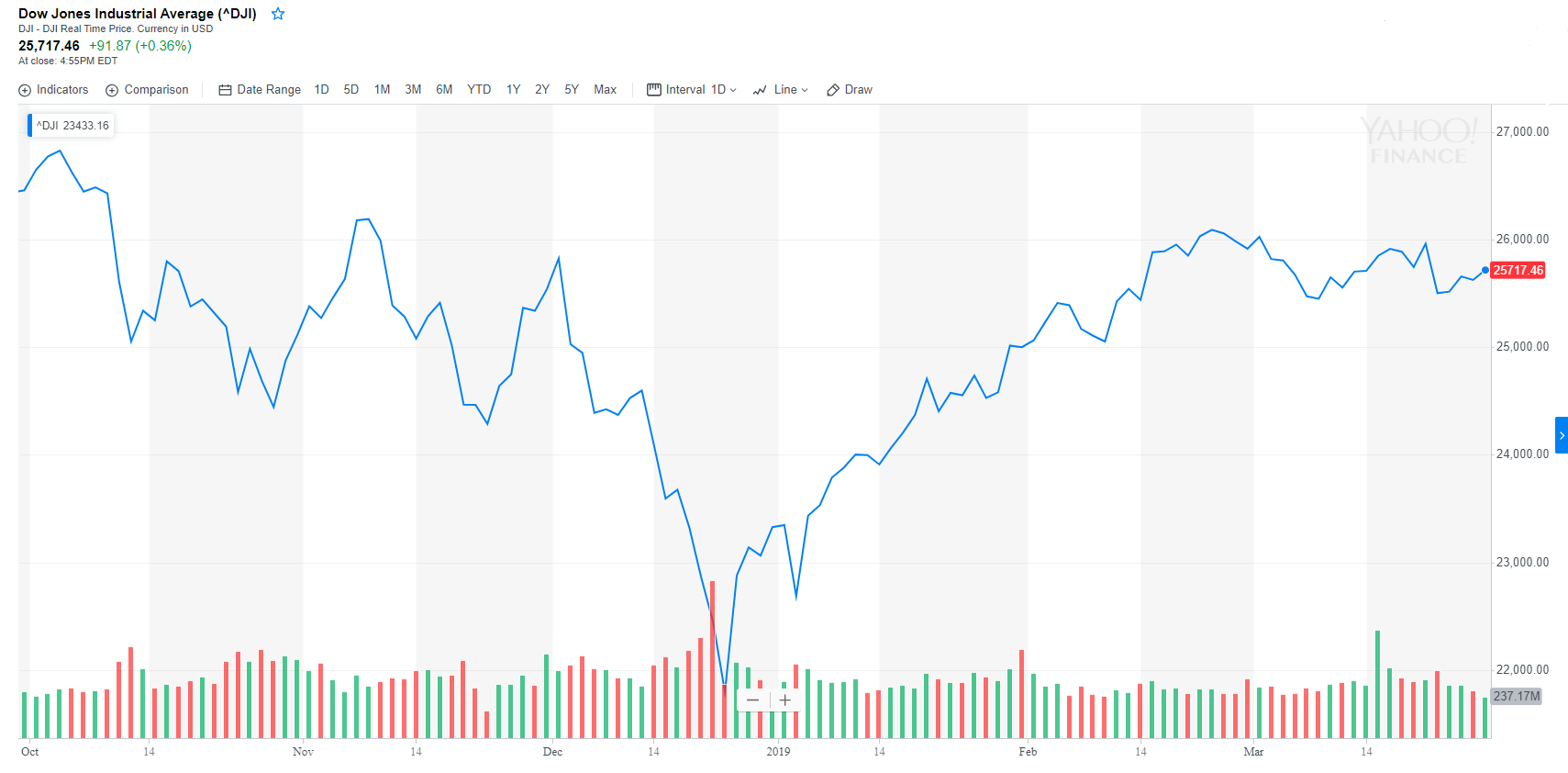

Despite signs of a global economic slowdown, the Dow Jones Industrial Average may be just hitting its stride. Stocks rose today even as investors reconcile worries about growth with a market that keeps finding reasons to rally.

Mainstay Capital Management’s CEO and CIO David Kudla shared his bullish view with TD Ameritrade Network, saying that even though the market recovery has been filled with volatility, the economy is still growing.

In a nod to the opening day of Major League Baseball, he said:

“We may be in the seventh or eighth inning of this bull market, but maybe we go into extra innings.”

“We might be in the seventh or eighth inning of this bull market – but maybe we go into extra innings.”

Even with the yield curve inversion, @David_Kudla @MainstayCapital says “we have more strength ahead for the market.” pic.twitter.com/5VdQXfJ7Sj

— TD Ameritrade Network (@TDANetwork) March 28, 2019

Chief among the economic concerns surround the possibility of a yield curve inversion, which is known to be a harbinger of a recession. Nonetheless, maybe there is a silver lining for the Dow and the broader stock market. Kudla recalls the last three times there was an inverted yield curve from 2-year to 10-year notes, which occurred against the backdrop of strength in the stock market.

“We had 20 months of more than 30% returns for the stock market before a recession. So even when we have the yield curve inversion, depending on what portion you look at, if you want to say it’s now, we have more strength ahead for the market,” said Kudla.

The Dow Jones Industrial Average is already up approximately 10% year-to-date.

IPO Market

Another sign that the environment for stocks is strong is the number of companies that are choosing to IPO now. Ride-sharing company Lyft just priced its shares at $72 per, which is at the higher end of its range. The tech unicorn already boasts a market cap of “$20.5 billion on a non-diluted basis,” according to CNBC. That’s comparable to the size of major airlines such as United Continental and bigger than Expedia. Kudla suggests that Lyft could “go to $100 the first day” of trading.”

Gives Lyft an initial market cap of $20.5 billion on a non-diluted basis.

That’s worth nearly as much as United Continental ($20.9b) and more than:

– American Airlines

– Best Buy

– Expedia

(and many other *profitable* companies)— Deirdre Bosa (@dee_bosa) March 28, 2019

Uber is expected to be right behind Lyft with its public market debut. Between the ride-sharing plays and denim company Levi Strauss, which IPO’d last week, the IPO market is in high gear. Even though the U.S. economy grew at a rate of just 2.2% last quarter versus previous estimates of 2.6%, it still grew, and private companies are looking to ride the tide of that expansion.

Corporate America is set to report their first quarter next month, and analysts are saying the slowdown has already been priced in by investors.