Republican Senators are warning President Donald Trump that imposing a new set of tariffs on foreign carmakers could be his undoing.

According to Politico, the Republican Senators have held several meetings and conversations on the matter with the president. In these interactions, the senators have tried to steer Trump away from imposing another set of tariffs on foreign carmakers.

The senators fear that such actions would harm Red states and increase the risk of an economic recession. This could harm Trump’s chances in his 2020 re-election campaign.

Don’t Undo the Good You’ve Done, Senators Warn Trump

One of the senators who has been lobbying Trump on this is Lamar Alexander, a Republican of Tennessee. Sen. Alexander has warned that the tariffs could ‘damage the autoworkers” in the South and the Midwest. Kentucky Senator, Rand Paul, has been more blunt:

If there’s no agreement and the tariffs get worse, my worry is that you could have a recession.

The senators are trying to lobby Trump as he weighs a decision of slapping new tariffs. A Department of Commerce report giving a legal justification for new tariffs was presented to Trump last month. He is expected to make a decision within 90 days of receiving the report.

Trade Wars Could Harm the Trump Economy

With Trump having promised to revive manufacturing in the United States, the tariffs could be a setback to his pledge. This would be the case if it leads to an economic downturn.

Blue-collar workers form a significant portion of Trump’s political base and his administration has made no secret of the fact that the booming economy has been good for this demographic.

Today, there are plenty of reasons for that trust. Manufacturing jobs are roaring back. Blue-collar workers are set to make almost $2,500 more in annual wages. We’re investing billions more in our military, and our service members are getting the best raise in nearly a decade. 🇺🇸

— The White House (@WhiteHouse) March 21, 2019

The recession fears cannot be dismissed though despite the stellar economic record Trump has enjoyed. Earlier this week, an inversion in the yield curve was taken as a signal that the U.S. economy is at risk of a recession. This was the first inversion on the yields of the 10-year treasury notes and the 3-month bills since mid-2007.

Should we Rush for the Exits now that the Bond Yield Curve has Flashed Red?

Per the San Francisco Federal Reserve, a recession has followed in the last nine occasions that the curve has inverted.

Don’t take your eyes off the yield curve. ” Research by the Federal Reserve Bank of San Francisco has shown that an inversion has preceded every U.S. recession for the past 60 years”. https://t.co/s57spYyuAG pic.twitter.com/sabivHRLkm

— Zoraida Sánchez (@Zoraida14_San) November 18, 2018

Some economists have, however, have pushed back against the recession narrative, according to the Financial Review. Former Federal Reserve chairman, Janet Yellen, recently pointed out that slowing growth was the only thing to worry about:

I don’t see a US recession as particularly likely. The US is certainly experiencing a slowing growth, that’s something that was long expected.

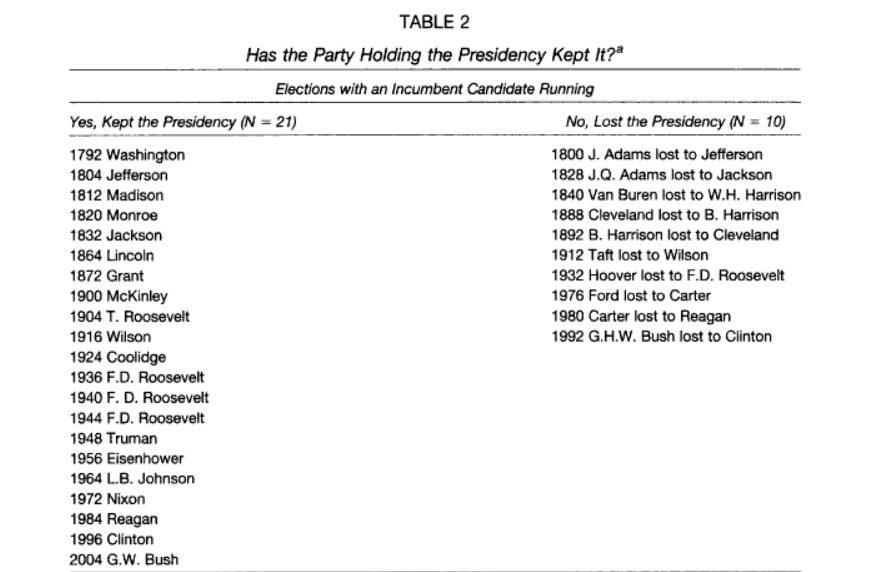

For the Republican Senators that could mean that Trump is not likely to listen to them. Additionally, Trump is obviously well aware that he enjoys the gift of political incumbency. Throughout U.S. history, incumbents have been reelected to 22 times and only lost a second term 10 times.