Since July 2018, due to a circular released by the Reserve Bank of India (RBI) in April, local banks were prohibited from dealing with bitcoin and cryptocurrency exchanges by the central bank.

Last month, the Supreme Court of India provided the government four weeks to draft a cryptocurrency regulatory framework, which would decide the legal landscape of the cryptocurrency market in India for the foreseeable future.

Depending on the outcome of the March 29 hearing set to occur four days from now, the future of the bitcoin and cryptocurrency exchange market of India will be decided.

Unpacking India’s Backdoor Bitcoin Ban

India implemented a backdoor ban on conventional crypto trading by making it nearly impossible for bitcoin exchanges to access financial services. | Source: Shutterstock

The usage of cryptocurrencies like bitcoin and ethereum is not banned or prohibited in the country. Only local banks working with the central bank, which essentially is the overwhelming majority of the banks in the country, are not permitted to work with cryptocurrency exchanges.

Hence, while it may be in the regulatory grey area, it is not against the law for cryptocurrency traders to buy or sell bitcoin through local over-the-counter (OTC) exchanges and peer-to-peer trading platforms using cash, as long as it does not involve local banks.

“If Zebpay bank accounts are disrupted, rupee deposits and withdrawals will become impossible…[However] Crypto deposits and withdrawals are continuing as usual. The RBI circular only talks to banks, and other regulated entities about shutting accounts. This doesn’t affect BTC and other cryptos,” local exchange Zebpay said at the time.

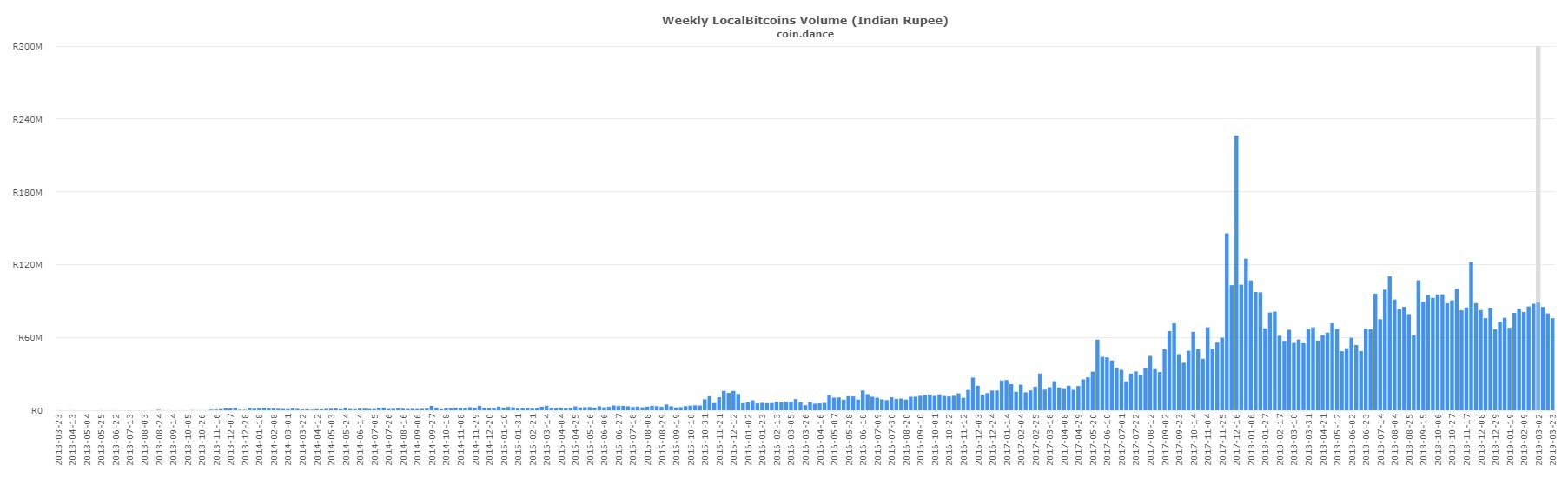

Consequently, following the crypto exchange banking blockade, the weekly volume of peer-to-peer exchanges such as LocalBitcoins increased noticeably.

Indian crypto traders have moved to peer-to-peer bitcoin trading platforms like LocalBitcoins. | Source: Coin Dance

Indian Officials Warm to Cryptocurrency

While the central bank has pushed for a blanket ban on cryptocurrency trading and many government officials have agreed with it, in recent months, the sentiment around cryptocurrencies has started to change.

Led by Finance Secretary Subhash Chandra Garg, the Department of Economics Affairs – which leads a committee composed of RBI, SEB, and Ministry of Electronics and Information Technology officials – is said to have come to a consensus on not completely dismissing cryptocurrencies as illegal methods of payment.

According to the New Indian Express, an official at the committee who asked to remain anonymous, said:

“We have already had two meetings. There is a general consensus that cryptocurrency cannot be dismissed as completely illegal. It needs to be legalized with strong riders. Deliberations are on. We will have more clarity soon.”

Money Laundering Concerns Could Lead India to Legalize Bitcoin Banking

There exists a possibility that India reverses the RBI’s ban on banks dealing with cryptocurrency exchanges if the government is concerned about potential money laundering risks.

If cryptocurrency trading moves from strictly regulated cryptocurrency exchanges to peer-to-peer platforms, it becomes extremely difficult for the government to prevent the usage of cryptocurrencies in processing illicit proceeds from criminal activities.

During a period in which the G20 is gearing towards regulation of bitcoin and cryptocurrency exchanges, it may be challenging for India to exclude itself from the global market.

How Japan Could Shape India’s New Crypto Regulations

In September 2018, CCN reported that the Securities and Exchange Board of India (SEBI) sent its officials to Japan to better understand the regulatory frameworks imposed by Japan.

Japan is known for its pro-cryptocurrency and blockchain policies and has facilitated the growth of its cryptocurrency exchange market well in the past two years.

The government of Japan and its Financial Services Agency (FSA) implemented a strict and rigorous verification process to filter out poor exchanges to strengthen its market.

If money laundering is the primary concern of the Indian government, it may lean towards the legalization of bitcoin and cryptocurrency trading with very strict regulations in place.