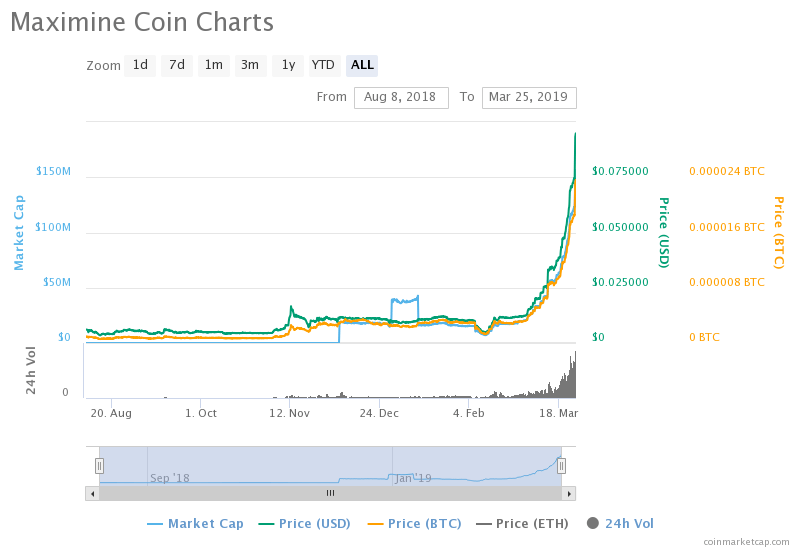

Maximine Coin’s MXM token is one of the leading performers in the crypto land for March.

The MXM-to-dollar rate today surged to 0.094, up 754.5-percent since the month’s open, in an aggressive upside swing. In the past 24 hours itself, the pair posted maximum gains, rising 30-percent on an adjusted timeframe. Simultaneously, MXM performed reasonably well against top crypto assets; it jumped 30.77-percent against bitcoin and 31.47-percent against ether.

The MXM’s market capitalization jumped approx $134 million between March 1 and today. Given the coin was and continues to be available on only a handful of crypto exchanges, the surge came a surprise. On a 24-hour adjusted timeframe, MXM noted $17.7 million worth of trading volume across CoinBene, HitBTC, and Livecoin, against Tether’s stablecoin USDT (over 86-percent), Ethereum’s ether (over 12.5-percent), and Bitcoin’s bitcoin (over 0.31-percent).

CoinBene handled 99-percent of the reported daily volume on Monday, which looks shady on the crust. Bitwise Asset Management, a San Francisco based firm, mentioned CoinBene as one of the leading wash trading crypto exchanges in its latest report (read our CCN report here for more information). The crypto trading platform is registered in Singapore just like Maximine Coin, which also runs its operations from the island city-state.

Who’s Buying MXM Coin?

Clear fundamentals for MXM were difficult to locate. On grounds, Maximine Coin remains a cloud-based mining pool service, which requires users to stake MXM coins for hashing power, which it calls The Hashing Power Credit System. Since its launch in August 2018, the MXM-to-dollar rate remained quite mum, seeing no high trading activities, only to rise abruptly in a February 2019 rally, which rippled through March.

With CoinBene hosting a crazy 99% of the overall MXM trades, there is a considerable possibility that only a few players participated in the ongoing rally. CCN checked Maximine Coin’s official Twitter handle, and most of the company’s tweets were self-patting: for media mentions and price surges. On the development front, Maximine Coin had only one activity in its GitHub repository, the one about its smart contract submitted in April last year.

Wow! $MXM hodlers, let me duly present to you @Coinpediamarket and its latest article. You no longer have to do your own #crypto price analysis! 🙌🏼🙌🏼

Link below! ⬇️⬇️https://t.co/Ktnbz0hzIY

— MaxiMine (@maximinecoin) March 24, 2019

Perhaps the only relevant fundamental we could find was BitForex. The Singapore-based cryptocurrency exchange announced Friday that it was going to list MXM pairs on its platform from March 26. At least that explains why investors found profitable intraday opportunities in MXM for today only. Rest assured, BitForex website does not tell anything about its founders and looks like another random addition to a mostly unregulated cryptocurrency sector.

Conclusion

On the whole, the MXM rally is shady yet attractive. Nevertheless, going large on its higher-high formations looks very risky at this time. Traders’ discretion is advised.