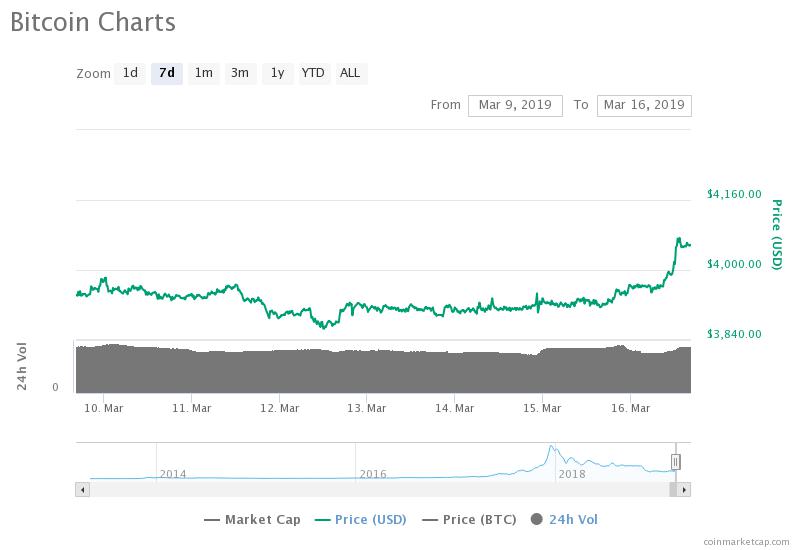

Overnight, the bitcoin price surged 3 percent against the U.S. dollar above the $4,000 mark as major crypto assets in the likes of ethereum, litecoin, and bitcoin cash recorded gains in the range of 6 to 18 percent.

Fueled by the momentum of bitcoin, the valuation of the crypto market spiked by $10 billion in the past week, which has been on the rise since March 12 due to the strong performance of tokens.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Can the Bitcoin Rally Continue?

According to cryptocurrency technical analyst Mayne, on the technical side, the price trend of bitcoin is not overly bearish as long as bitcoin remains above $3,693, its yearly open.

“I’ve said this for a while, as long as we are above the yearly open on BTC ($3,693) and ETH ($130.90) there is no reason to be overly bearish. BTC following the squiggly, if we break through here I expect a move to $4,100,” the analyst said.

As such, if bitcoin is able to maintain its momentum above key resistance levels including $4,000, there exists a possibility that the dominant cryptocurrency can continue to engage in an upside movement.

However, in an interview with CCN, cryptocurrency trader DonAlt explained that the minimal price movement in bitcoin, while alternative cryptocurrencies are surging in value, suggests that the inflow of capital into the cryptocurrency market is low.

Hence, for the upside movement of the cryptocurrency market to be sustained, the trader said that the price of bitcoin will also have to move in a positive direction.

Market God Indicator 3w buy signal. The first since October 2016. $BTC was $500. pic.twitter.com/oaqNZ7Q1h8

— Crypto Thies (@KingThies) March 16, 2019

In the near-term, similar to what former International Monetary Fund (IMF) economist Mark Dow said, DonAlt noted that it is crucial for bitcoin to climb up to $4,600, favorably to $6,000, to avoid retesting its lows.

The trader said:

Volume isn’t what will convince me that the bear market is over, a bullish market structure along with a break of at least $4.6k (Favorably $6k) is. It’s interesting that we’ve had so many altcoin pumps while the general market cap hasn’t really changed. That makes me think there is very little new money coming in.

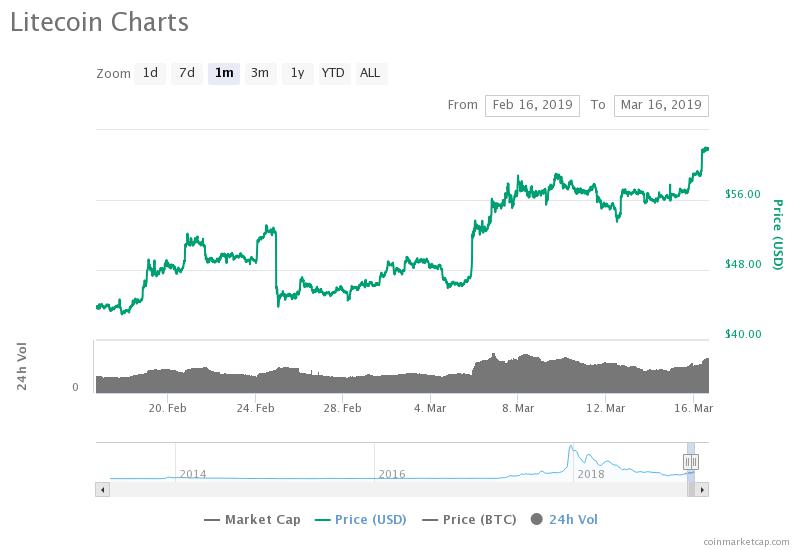

Apart from bitcoin and ethereum, litecoin remains as one of the best performing crypto assets year-to-date.

Since January, the price of litecoin has spiked from around $31 to $61.9, by nearly 100 percent against the U.S. dollar.

The performance of litecoin is mainly attributed to its growing developer activity, especially in the area of privacy solutions such as Confidential Transactions and Mimblewimble.

Rising Volume

In recent weeks, the volume of major cryptocurrencies including bitcoin has increased substantially, demonstrating an overall increase in trading activity.

Bitcoin, for instance, saw its volume spike to over $10 billion and if the volume of the over-the-counter (OTC) market is added, its volume could near somewhere around $15 billion.

Last month, economist Alex Krüger said that the bitcoin chart is showing indicators of a bottom but it cannot be confirmed if it does not test key resistance levels.

“Short term longs above 3550, 3700 key level below (buy), 4200 key level above. Charts scream bottom, yet regardless of any bullish developments, interest in the space is still minimal. If price turns south of 3550 a new low becomes likely. The future is path dependent,” he said.

The last time bitcoin tested $4,000 and spiked to around $4,200, it dropped back down to the $3,700 region. It remains to be seen whether bitcoin can climb beyond the crucial $4,200 and $4,600 resistance levels in the weeks to come.