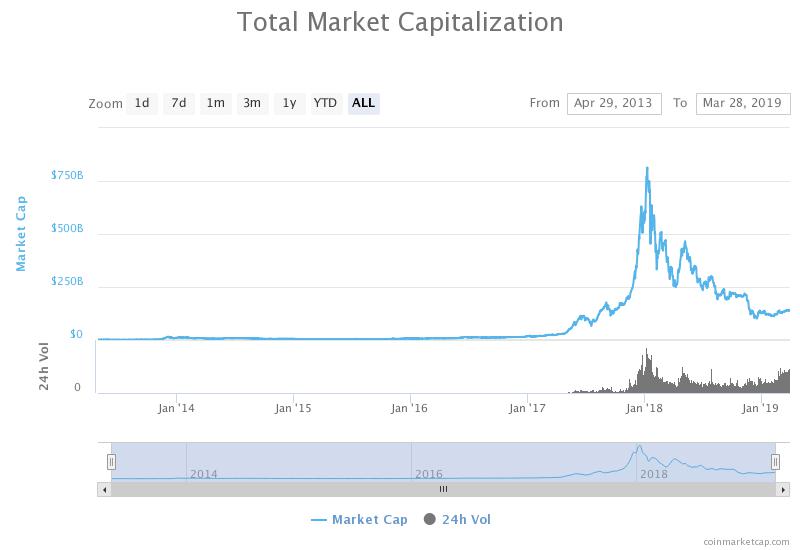

Down more than 82 percent from its all-time high at $813 billion, the crypto market technically remains neck-deep in a 15-month long bear market that began in January 2018.

The valuation of the crypto market is down from $813 billion, still deep in a bear market (Source: coinmarketcap.com)

But, in recent months, with support from some of the largest financial institutions in the global market, the crypto industry has seen significant progress in areas including institutionalization, regulation, and adoption.

This week, reports have revealed that two major funds in the crypto market Pantera Capital and XRP Capital are finalizing a $175 million fund and $100 million fund, respectively, with freshly raised capital.

Massive Funding Rounds Bolster Crypto Despite Waning Retail Interest

During a bear market of any industry or asset class, activity of companies, projects, developers, and investment firms often slumps as the interest towards the sector declines substantially.

Indicators like Google Trends suggest that the general interest towards cryptocurrencies as an asset class has dropped noticeably in the past 12 months, which was expected due to the sheer scale of the bitcoin bull market and the frenzy fueled by retail investors at the time.

As interest drops, generally, the inflow of capital from investment firms, accredited investors, and retail investors also declines, leaving many projects at risk of capitulating and shutting down.

While that has been true for the overwhelming majority of projects in the space, quality projects, teams, investment firms, and companies have been able to raise new capital and continue to expand amidst one of the worst bear markets in the history of cryptocurrency.

The inflow of capital into the cryptocurrency space has certainly dropped in the past 15 months. But, crucially, increasing capital has been allocated to quality projects and teams that are executing, raising the overall standard of the bitcoin industry.

Investment firms like Pantera Capital, the first billion-dollar fund in the cryptocurrency sector, have been successful in raising hundreds of millions of dollars during a steep correction because investors remain confident that quality projects will survive the so-called Crypto Winter.

In an investor letter, the Pantera Capital team wrote:

“We have raised $160mm of the $175mm target for Venture Fund III. We’re wrapping up the final close this month.”

The Pantera Capital team noted that in the months to come, the firm would help investors target businesses opening in emerging markets or developing jurisdictions.

Regions like Southeast Asia have shown an exponential increase in adoption in recent years. One out of ten adults in the Philippines is said to be using Coins.ph, the biggest cryptocurrency exchange, remittance app, and bill payments platform in Southeast Asia.

The team said:

“However, there is an additional opportunity for players who know a certain market really well, because the institutional-grade exchanges can’t go after every market all at once. So, the second type of exchange we are investing in are ones in developing jurisdictions, where crypto is just starting to get traction. While some of these exchanges may not have a ton of volume today, they’re far and away the market leader in whatever jurisdiction they’re leading in.”

Michael Arrington, the founder of TechCrunch and XRP Capital, also disclosed that following the closure of a $30 million round this week, the firm has surpassed its initial target of $100 million.

Why is the Bear Market Appealing to Investors?

In the bear market, the valuation of both crypto assets and companies drop to a reasonable level that may be compelling to investors that feel they have missed the previous wave of bitcoin fever

It presents viable opportunities for acquisitions and enables investors to invest in companies that are structured more efficiently in dealing with compliance and growth.