Blockchain investigation and cybersecurity firm CipherBlade has done its own research, the results of which seem to exonerate crypto exchange ShapeShift from a scathing report in The Wall Street Journal. Shapeshift CEO Erik Voorhees was the first to tout the results, which exposed holes in the Journal’s methodology, knowledge of crypto, and other shortcomings.

In CipherBlade’s published response, the firm dismantles the Journal’s key allegations one by one, chief among which was that ShapeShift facilitated a $9 million laundering comprised of swapping bitcoin and Ethereum for under-the-radar coins like Monero. WSJ journalists offered little proof of their claims, and the cybersecurity firm used the transparency of the blockchain to defend ShapeShift. Turns out these allegations were “overstated by a factor of 4x,” according to CipherBlade.

While Voorhees is seemingly feeling vindicated, he is also looking for the WSJ to make it official.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

A respectable publication would issue a retraction or correction. WSJ made up false claims against @ShapeShift_io both quantitative and qualitative, in order to push an anti-crypto, pro-bank surveillance agenda. WSJ may lie, but blockchains don’t… https://t.co/zYl0Qt8IsR

— Erik Voorhees (@ErikVoorhees) March 21, 2019

The WSJ article, which was published in September 2018, was entitled “How Dirty Money Disappears Into the Black Hole of Cryptocurrency,” targeting ShapeShift. CipherBlade’s response, which was commissioned by ShapeShift, is: “How Truth Disappears Into the Black Hole of Shoddy Journalism,” and it is a “forensic review” of the Journal’s findings. Touche.

Some social media followers were quick to criticize Voorhees for hiring CipherBlade to uncover the truth. Others in the crypto community have defended both the exchange and its leader, including EOS New York Co-Founder Rick Schlesinger.

United in solidarity with @ErikVoorhees and @ShapeShift_io as they battle falsehoods and misrepresentations published by @WSJ about their services. Keep up the great work Erik helping to correct the record in this unfortunate state of journalism. https://t.co/6NNYEMLRjh

— Rick Schlesinger (@rschlesinger) October 3, 2018

Debunking the WSJ’s Claims

CipherBlade’s analysis honed on in a trio of the WSJ’s claims:

- Software and investigative methods used by reporters

- Blockchain transactions used to make their findings

- Approach taken by the authorities to probe similar cases

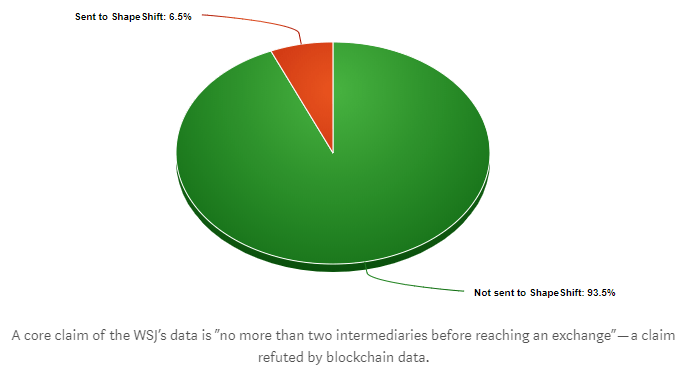

Following months of fact-checking, the investigative firm debunked some of the findings in the Journal’s report. For one, the WSJ’s investigation into laundering was “fundamentally flawed,” relying on ” “no more than two intermediaries before reaching an exchange.” The process to trace funds “illicit or not” across numerous transactions is complex, making the Journal’s “flawed standard” unable to produce anything but “inevitably distorted” laundering allegations.

“Applying a more proper methodology, we determined that only 1% of the ETH from the suspicious wallets was traded for any asset through ShapeShift. This means the WSJ’s $9 million “laundering” claim was overstated by a factor of 4x.” stated CipherBlade.

The analysis goes on to suggest that the WSJ targeted ShapeShift despite the fact that its procedures were “routine across any cryptocurrency exchange.” CipherBlade defended ShapeShift, saying that the exchange’s dealings with investigators have been “open” despite claims otherwise by the WSJ. CipherBlade stated:

“ShapeShift does not facilitate money laundering — rather, their transparency and cooperation are crucial resources that greatly benefit any given investigation.”

Meanwhile, CipherBlade went on to criticize the WSJ reporters for their knowledge of the blockchain and cryptocurrency. The journal claims to have “built computer programs that tracked funds from more than 2,500 potentially criminal cryptocurrency wallets,” an assertion that CipherBlade says is “implausible” and casts a shadow over the accuracy of the Journal’s findings.

Further, the CipherBlade analysis determines that only a small fraction (less than 7%) of the thousands of “suspicious wallets” identified by the WSJ actually ever sent any funds to ShapeShift within a trio of transactions, which was part of the criteria. “[Those] that did exchanged the majority for traceable, non-private cryptocurrencies,” stated CipherBlade.

Stigma Lifting

ShapeShift has since overhauled its sign-up procedures, adding protocols such as know-your-customer to a model that previously catered to anonymity. The shift was in response to regulatory pressure, and it has taken a toll, as evidenced by layoffs announced by Voorhees earlier this year.

Nonetheless, CipherBlade’s pursuit to uncover the truth has delivered a one-two punch to the mainstream financial media and their coverage of crypto. In doing so, a stigma that has plagued the exchange not to mention crypto trading more broadly may be beginning to lift, even if ShapeShift never becomes as regulatory friendly as some of its peers.