In recent months, the substantial increase in the daily volume of bitcoin and the rest of the cryptocurrency market has led analysts to suggest that the overall trading activity in the market is rising.

While some stated that the minimal impact on the bitcoin price despite the large movements of alternative cryptocurrencies show a small inflow of capital into the crypto market, the general sentiment regarding the asset class has improved.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

$BTC 3D is riding/holding above the 20MA on the @bbands, for the first time since end of 2017 Bull Trend

— Crypto Thies (@KingThies) March 17, 2019

According to one technical analyst, for the first time since the bull run in late 2017, a technical indicator called Bollinger Bands is holding above the 30 moving average (MA) level, which often signals a positive upside movement.

Can Bitcoin Engage in Strong Movement?

Throughout the past three months, bitcoin has struggled to move out of a tight range from mid-$3,000 to $4,000.

On two occasions wherein bitcoin breached the $4,000 mark, the dominant cryptocurrency retraced fairly quickly back to the $3,800 to $3,900 range.

For a breakout above the $4,000 to hold, several technical analysts including DonAlt have emphasized that it is important for the asset to test key resistance levels, like $4,300 and $4,600.

“Volume isn’t what will convince me that the bear market is over, a bullish market structure along with a break of at least $4.6k (Favorably $6k) is. It’s interesting that we’ve had so many altcoin pumps while the general market cap hasn’t really changed. That makes me think there is very little new money coming in,” the analyst told CCN.

The $4,300 level could be crucial in the near-term because as one cryptocurrency trader explained, there are a relatively large number of short contracts stacked up in the $4,200 to $4,300 range.

If bitcoin initiates an optimistic price movement above $4,300, it could trigger a short squeeze and fuel its near-term momentum.

Someone very clearly defending shorts in this range. Going to get ugly for them if 4300 breaks…$BTC pic.twitter.com/A1XSJ4yjL0

— Flood [BitMEX] (@ThinkingUSD) March 18, 2019

But, whether bitcoin can move past key resistance levels remains unclear as many analysts are cautiously optimistic about the performance of the asset.

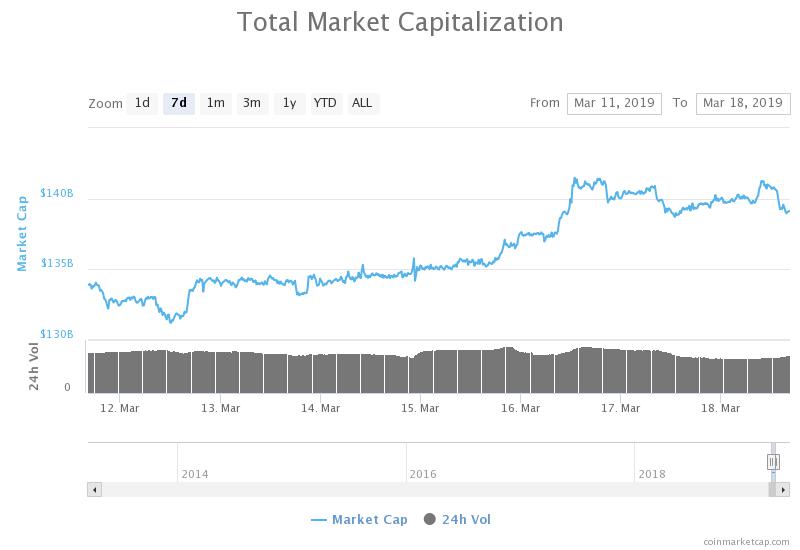

On March 17, following a strong week for alternative cryptocurrencies and tokens, the cryptocurrency market retraced slightly from $141 billion to $139 billion, by about 1.4 percent.

The retrace was minimal considering the gain of the cryptocurrency market throughout the past 7 days and the market could continue to see an extended period of accumulation if bitcoin can maintain its momentum in the short-term.

Some cryptocurrencies such as Enjin Coin, which experienced an impressive 80 percent rally against bitcoin earlier this month due to its reportedly high-profile partnership with Samsung’s Galaxy s10 crytpo wallet recorded large gains on the day

Potential Bakkt Delay

Based on reports, the launch of Bakkt, the highly anticipated bitcoin futures market operated by ICE, the parent company of the New York Stock Exchange, will most likely not be able to launch its futures exchange by the first quarter in 2019.

Even until late February, CFTC’s Division of Market Oversight was reportedly reviewing the proposal of Bakkt and as such, the earliest Bakkt could launch is in the second quarter of this year.

Throughout the past 12 months, Bakkt has been considered as one of the fundamental catalysts that could contribute in institutionalizing the cryptocurrency sector.

As government enforcement defense and securities litigation attorney at Kobre& Kim Jake Chervinsky said in November 2018, Bakkt may be going through months of negotiations with the CFTC.

“Consider the process that CME & CBOE went through to get approval for their bitcoin futures last year. Both of them ended up self-certifying, but only after *months* of negotiations with the CFTC & changes to their products,” he said.